What is Predatory Lending?

I Get It: Payday and Online Business Loans are Bad – But I Need One!

As a nonprofit that provides interest-free loans, too often we see that our applicants are burdened by what we consider “predatory” loans and credit cards.

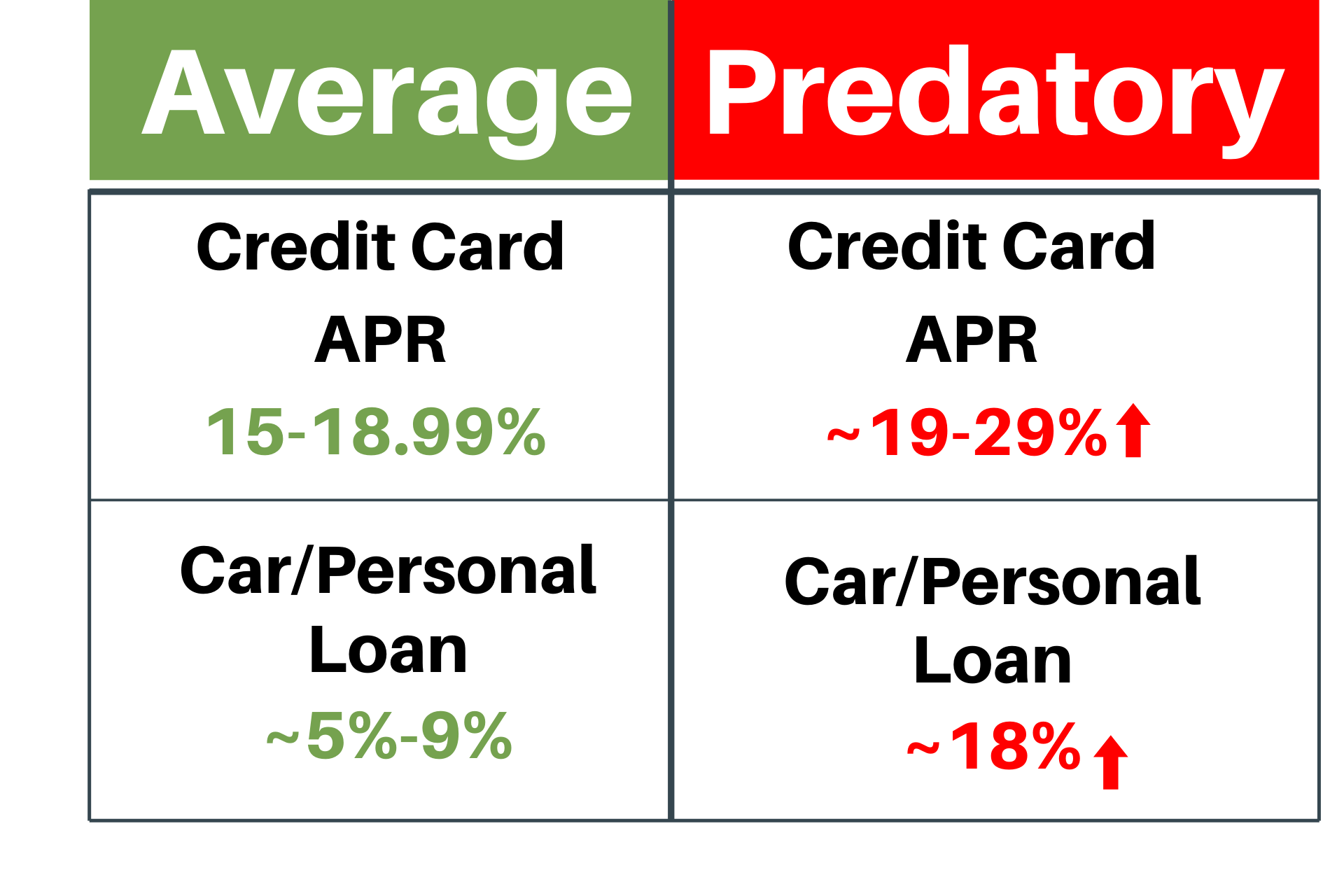

Predatory loans or credit cards have excessive interest rates, or interest rates that are much higher than the average. Typical Annual Percentage Rates (APRs) for a credit card can be around 15-18%, whereas predatory credit cards have APRs from 20-29%. A predatory rate for personal or car loans is generally over 18%. These interest rates result in unaffordable payments, excessively long loan terms, and/or debt that seems impossible to get out from under. They are designed this way; for corporations to make money off of lending money.

Predatory lending includes payday and auto title loans. Our Executive Director fought tirelessly with the Ohioans for Payday Loan Reform Coalition to place a percentage cap on payday lending interest rates to stop this cycle of preying on financially insecure individuals. Despite these recent sanctions, Ohioans are still at risk of predatory loan rates. We often see people get into trouble by taking out loans through online lenders that originate outside of Ohio where these sanctions do not apply. Some of these loans bear interest in the triple digits! We have seen interest rates well over 500% from these online loans. HFLA’s program staff helped a woman get out of a loan with a 638% APR just last week.

Before you take out a high interest rate loan, read this article.

Every week, we speak to people who are burdened by high interest predatory loans. We realize that often the only choice that many people have when it comes to getting the financing that they need. For many people, this could be the first time they have ever been able to get financed due to poor credit history, or no credit history.

In their excitement to solve their pressing financial issue, the high interest rate or bi-weekly payment schedule is overlooked. Predatory lending preys on desperate situations and bad timing. They are financing options disguised and advertised as “good opportunities” to those who have bad credit and even promote “credit building” as a part of the lure. The reality is that they often force people to borrow more than they need, and the repayment can lead to a downward spiral of debt that is almost impossible to get back out of.

Individuals seeking personal loans are not the only ones at risk of predatory lenders. Small business owners have become a new target for high-interest lending. Business loans are typically very hard to get, especially for startup companies. Predatory interest rates–typically found from online lenders–can be up to 49% APR.

Our call to action: Always be wary of any financing option you apply for.

1. If someone solicits you for a loan or credit card — RED FLAG — this is likely predatory.

-

-

Someone is trying to seek you out to give you money? Sounds too good to be true! Probably because they are going to make money off of you.

-

2. Read through the terms and conditions of the loan or credit card you are applying for.

-

-

Look for the Truth in Lending Act (TILA) in the document. This page will list the amount financed, the finance charge, the Annual Percentage Rate, and what the total amount of the payments will be at the end of the loan.

-

3. If you are currently having trouble managing your debt or have high interest rates on your loan or credit cards: Seek out help from a free financial counselor or coach today!

Here are some of the financial counseling services offered by nonprofits in the Northeast Ohio Region that we recommend:

- Cleveland Neighborhood Progress – communityfinancialcenters.org

- ESOP at Benjamin Rose Institute on Aging (for seniors and housing) – esop-cleveland.org

- United Way’s Financial Empowerment Center (FEC) – uwsummit.org/FEC

- CHN Housing Partners – chnhousingpartners.org

Resources for small business owners:

- ECDI (throughout Ohio) & the Women’s Business Center – ECDI.org

- Ohio Small Business Development Centers (SBDCs) – clients.ohiosbdc.ohio.gov

- SCORE – score.org

About HFLA of Northeast Ohio

HFLA of Northeast Ohio was founded in 1904 with $501 donated by Charles Ettinger, Morris Black, and their friends to help European refugees settle and begin productive lives in this country. They believed – as we do now – that if you give someone a chance to succeed, they will pay it back and we can continue this transformative cycle. The same principle guides the organization today. By providing interest-free loans to individuals, families, and small businesses in the Northeast Ohio area, we are able to help people help themselves. The association has drastically increased its lending capital in the past few years from individual gifts, bequests, endowments, foundation grants, memorials and honorariums and is now operating with a loan fund of over $1 million. HFLA is a 501(c)3 non-profit organization. Learn more about HFLA.

Get involved and stay up to date by subscribing to our quarterly newsletter or following us on social media.

Information on Payday Loan Reform Legislation

The Ohioans for Payday Loan Reform Coalition reached out to HFLA after Michal's interview on NPR, and provided us with the following information for anyone who may be interested in House Bill 123 and the current reform efforts:

Dear Supporters of Payday Loan Reforms:

The payday lending reform bill, Ohio House Bill 123, has been assigned to the House Government Accountability & Oversight Committee, chaired by Rep. Louis “Bill’’ Blessing III, R-District 29, who represents part of Hamilton County.

We are asking you to reach out to committee members from Cuyahoga County, the chairman of the committee and committee members who have announced they are going to run for statewide office in upcoming elections. Please tell the committee members that you support reform and why. If they are running for statewide office, please mention that in your communication.

Also, if you live in one of these legislators’ districts, would you please let us know? If you do, we can let you know when they are holding in-district public meetings which you might be able to attend to bring up payday lending reform.

Cuyahoga County committee members:

Rep. Dave Greenspan, District 16; western Cuyahoga County, including Westlake, Bay Village, Rocky River, Fairview Park, North Olmsted

- Email here: http://www.ohiohouse.gov/dave-

greenspan/contact - Call 614.466.0961

Committee Chair

Chairman Rep. Louis “Bill’’ Blessing III, District 29; Hamilton County/Southwest Ohio

- Email here: http://www.ohiohouse.gov/

louis-blessing/contact - Call 614.466.9091

Other committee members:

Vice Chair Rep. Bill Reineke, District 88; Sandusky and Seneca counties

- Email here: http://www.ohiohouse.gov/bill-

reineke/contact - Call 614.466.1374

Rep. Timothy E. Ginter, District 5; Columbiana County

- Email here: http://www.ohiohouse.gov/

timothy-e-ginter/contact - Call 614.466.8022

Rep. Bernadine Kennedy Kent, District 25; part of Franklin County, including Whitehall, Gahanna, Bexley and part of Columbus

- Email here: http://www.ohiohouse.gov/

bernadine-kennedy-kent/contact - Call 614.466.5343

Rep. Ryan Smith, District 93; Lawrence, Gallia, Jackson and part of Vinton counties

- Email here: http://www.ohiohouse.gov/ryan-

smith/contact - Call 614.466.1366

Rep. Bill Seitz, District 30; parts of Hamilton County

- Email here: http://www.ohiohouse.gov/bill-

seitz/contact - Call 614.466.8258

Key news media coverage of reform efforts

- March 27, Columbus Dispatch, Editorial, It’s time to rein in payday lenders, http://www.dispatch.com/

opinion/20170327/editorial- its-time-to-rein-in-payday- lenders - March 24, Canton Repository, Editorial, State lawmakers consider new rules for payday lenders,

- http://www.cantonrep.com/

opinion/20170323/editorial- state-lawmakers-consider-new- rules-for-payday-lenders/1 - March 20, WCPN Cleveland, Sound of Ideas show, payday lending panel including Rep. Koehler, http://www.ideastream.org/

programs/sound-of-ideas/ payday-lending-0 - March 19, Columbus Dispatch, As Ohio payday lending law fails, some lawmakers ready for new regulations, http://www.dispatch.com/news/

20170319/as-ohio-payday- lending-law-fails-some- lawmakers-ready-for-new- regulations - March 19, Crain’s Cleveland Business, Get it right, http://www.crainscleveland.

com/article/20170319/VOICES01/ 170319824/crains-editorial- get-it-right?X- IgnoreUserAgent=1 - March 17, Statehouse News Bureau, Another crackdown on payday lenders back to lawmakers, but industry is ready to right back, http://statenews.org/post/

another-crackdown-payday- lenders-back-lawmakers- industry-ready-push-back