Standard Loans address the unexpected financial challenges that people who are unable to access traditional financing face. Many people do not have access to funds when financial challenges occur. These situations can include home and car repairs, high-interest debt, emergency funerals, falling behind on bills and more.

Education Loans address the gap that is often needed in order to pursue undergraduate, graduate, vocational and technical schools. This burden often comes between the student attending or finishing their education. These loans are need-based.

Business Loans address small businesses and start-ups need for capital when traditional lenders are unwilling to take on the risk. HFLA’s 0% interest loans enable businesses to meet demand and grow their company. This is our fastest growing loan portfolio and currently represents 26% of HFLA’s loans.

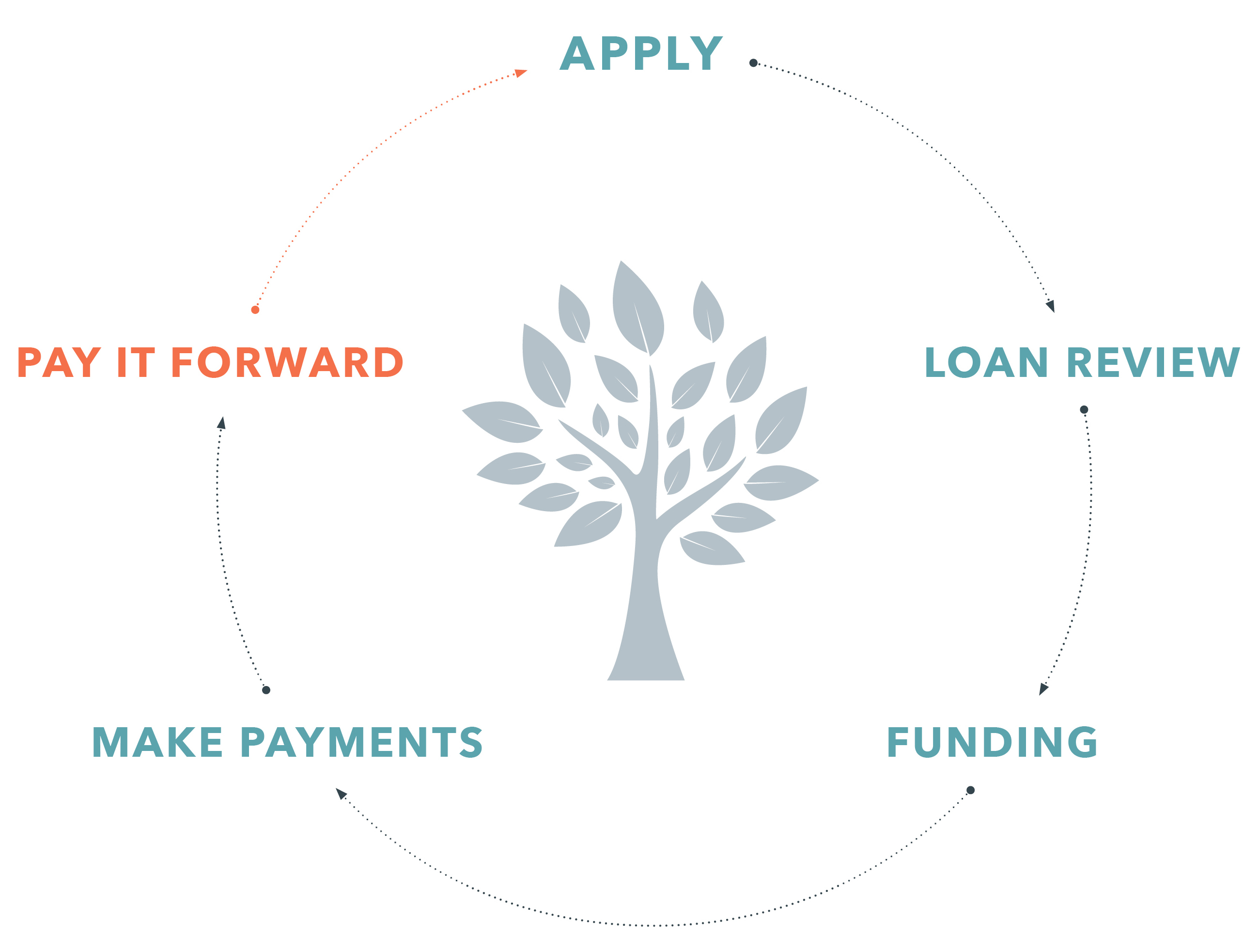

01 Apply

Find the loan type that is best for you! Complete the application, turn in your documents and your guarantor(s)’ application(s). How to Apply.

02 Loan Review

HFLA staff will review each application and will contact you and/or your

guarantors with any questions. If, based on your budget and supporting financial documents, the loan application looks viable, HFLA brings the applicant to loan committee, either in-person or virtually.

03 Funding

The applicant is notified—typically within one business day–whether or not

the loan has been approved. Approved borrowers and guarantors will then agree to the repayment terms and receive their check(s) made out to their creditors/sources of need.

04 Make Payments

Borrowers begin making payments within 30 days and continuously for the duration of their loan. These loan

payments go back out to the community in the form of new loans to our next loan applicants!

05 Pay it Forward

Help HFLA continue to make interest-free loans! If you feel more financially secure at the end of your loan term, you can make a donation, serve as a guarantor for someone else, and/or tell others in need about our interest-free loans.