Celebrating Centrovilla

Located on Cleveland’s near west side, the Clark-Fulton neighborhood is one of the city’s most densely populated and ethnically diverse communities, including the highest concentration of Hispanics in the city.

The Northeast Ohio Hispanic Center for Economic Development (NEOHCED) is the umbrella organization for the Northeast Ohio Hispanic Chamber of Commerce, the Hispanic Business Center, and Hispanic Community Development. NEOHCED is the lead organization for the redevelopment and placemaking initiative–La Villa Hispana.

For ten years, this coalition of organizations has been working to achieve their vision of a community “hub” that celebrates the rich Latino heritage in the Clark-Fulton neighborhood, while fostering substantial economic growth. These grand visions have become a reality with the completion of CentroVilla25! The building, with over 32,000 square feet of space, is home to 20 microenterprises, including a food hall representing several Latin cultures and retail options. Jenice Contreras, the President and CEO of NEOHCED, excitedly shares, “You’ll smell it, taste it, feel it, experience everything that is CentroVilla 25 and what the vendors and the community bring.”

Investing in these spaces will draw people into the neighborhood and breathe new life into the soul of the community. The most valuable aspect of this project is supporting individuals already part of this community. HFLA is proud to have provided business loans to seven businesses settling into their new spaces in CentroVilla25. Five are food businesses, each boasting its own unique flavor, culture, and history. We are thrilled to witness the excitement on our borrowers’ faces as their dreams become a reality.

Here is a listing of all the small business owners operating at CV25:

Realtor Joel Rodriguez Velez – Real estate services

Antojitos Salvadoreños y Más – Authentic Salvadoran food

Mine’Angel Collections – Handcrafted jewelry

Tumbao58 – Venezuelan eats with bold flavor

Flying Pig Tacos – Mexican street-style tacos

Sazón Latino – Classic Cuban dishes

Panitos – Salvadoran pastries & breads

Café Roig – Puerto Rican coffee & sweets

JirehBoutique – Trendy clothing & accessories

Alnairis’s Custom Design – Custom tumblers & gifts

Lebeni.Esthetic LLC – Facials & body care

Vintage & Vaina – Collectibles, games & toys with retro flair!

Marie Narvarro is quick to tell you how excited she is to see her business, Tumbao55, take off. Coming to the US in 2020, she decided to take her passion for cooking to the next level.

She has loved interacting with the community at large, finding that she had no choice but to learn about the foods, behaviors, and general cultures of the new space she was inhabiting. As much as she is loyal to Venezuela, her home country, interacting with the various Latino communities here in Cleveland has allowed her to appreciate the vast diversity of foods available, broadening her mind and palate. “Every country has its secret, its flavors. It’s not competition, it’s like ‘Oh, I want to share’.” Tumbao is her chance to give a little slice of home to every customer who comes in.

“HFLA was the light at the end of the tunnel,” Marie said with a smile. She had saved up enough money to feel like she had the foundation for her business, and noted that luckily, HFLA believed in her and became the final step in making her dream come true. “Everything is very exciting.”

She’s grateful for organizations like HBC and Jumpstart for giving the Latino community resources to get ahead. “We are raising our voices, and they’re seeing we have the strength to be a part of this community too and help develop this country in the best way possible.”

Watch Marie’s full interview with HFLA’s Development Associate Alexis Paredes here.

The grand opening for CentroVilla is May 31st! Find tickets for all their events here!

Ribbon Cutting Ceremony: May 30th, 10 AM

Inaugural Gala: May 30th, 6 PM

Sabor y Ritmo Festival: May 31st, 1 PM

CentroVilla Hours:

Monday: Closed

Tuesday – Saturday: 8 AM – 8 PM

Sunday: 10 AM – 6 PM

An Attack on Education

“Education is our most important national investment.” - President Jimmy Carter

In October 1979, under Jimmy Carter's presidency, the Department of Education was created with the mission of strengthening “the Federal commitment to ensuring access to equal educational opportunity for every individual” and supporting “more effectively States, localities and public and private institutions in carrying out their responsibilities for education.” Operations officially began in May 1980.

On March 20th, 2025, current President Donald Trump signed the Improving Education Outcomes by Empowering Parents, States, and Communities Executive Order, imploring the closing of the Department of Education. President Trump believes that the current way the department is being managed makes it ill-equipped to handle the student loan debt portfolio and overtly prioritizes “illegal discrimination” via diversity, equity, and inclusion initiatives.

Accessibility to higher education is under threat, with diversity-based scholarships on the chopping block. In a letter from the Department of Education’s Office for Civil Rights, Acting Assistant Secretary Craig Trainor wrote that race cannot be factored into various decisions, including financial aid and scholarships.

Race blind scholarships and grants aren’t safe either. The Pell Grant program, which is received by 34% of undergraduate students, distributes aid to students who show financial need to support their education. The program is currently expected to run out of reserves by the end of 2025, hitting a $71-111 billion shortfall over the next 10 years. Federal funding could be used to fill this deficit, but in February 2025, the US House of Representatives passed a budget resolution to cut $330 billion for education and workforce spending over the next decade, voting against giving education the resources needed to make the system prosperous.

Though we cannot rectify all current situations, we can still strive to support education wherever possible. HFLA’s education loans are need-based financial opportunities that students can utilize to achieve their academic goals. We also cover experiences that extend beyond the typical four-year undergraduate programs. Education should feel like an attainable goal for dedicated students, rather than an insurmountable challenge. HFLA is here to assist anyone wishing to pursue a new lifestyle, and finances should not become a barrier.

If you believe that limiting education and efforts to eliminate the Department of Education should not be pushed, call your representatives to voice your opposition to striking down the Department of Education:

If you are in Ohio, here are the numbers to call:

Senator Bernie Moreno: 202-224-2315

Senator John Husted: 202-224-3353

Representative Shontel Brown (Northeast Ohio): 202-225-7032

Script:

Hi, my name is [NAME] and I’m a constituent from [CITY, ZIP].

I’m calling to demand that [REP/SEN NAME] strongly oppose H.R. 899 and Trump's executive order to dismantle the Department of Education. It is crucial that Congress stand firm against this blatant executive overreach and protect the Department's vital programs and protections for students.

Thank you for your time and consideration.

IF LEAVING VOICEMAIL: Please leave your full street address to ensure your call is tallied.

(Script provided by the 5 Calls app)

2024 Annual Report

We are pleased to share our 2024 annual report!

The organization saw a lot of activity in 2024 – a new location, new staff members, and a new attitude! Last year saw a lot of change, which prepared us for a strong start to 2025. In the first quarter of 2025, we made 14 loans totaling $83,405! Our primary goal in increasing our staff capacity is to build upon and improve our application experience and what support we can offer during and after loan repayment. We can’t wait to share what we’ve got in store for this year.

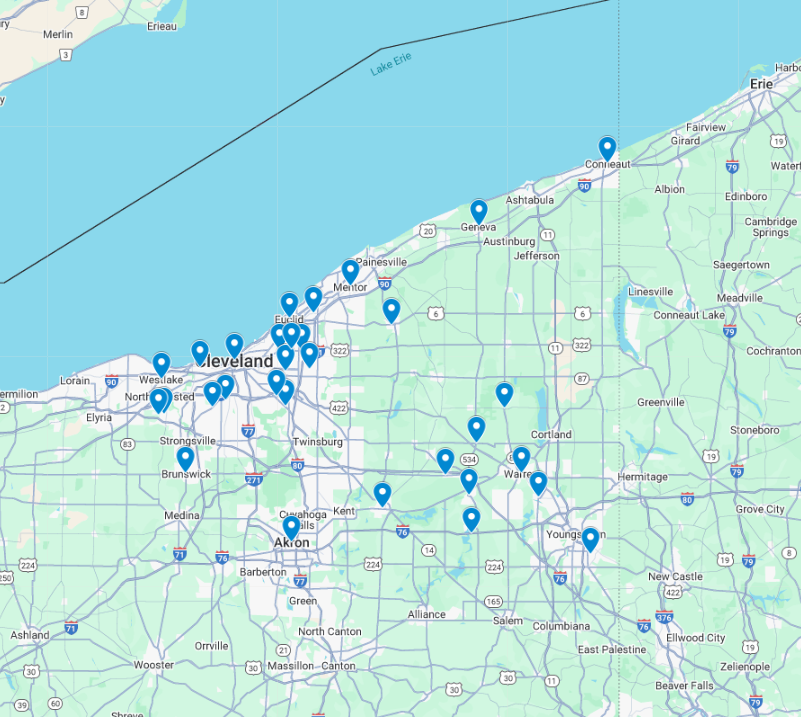

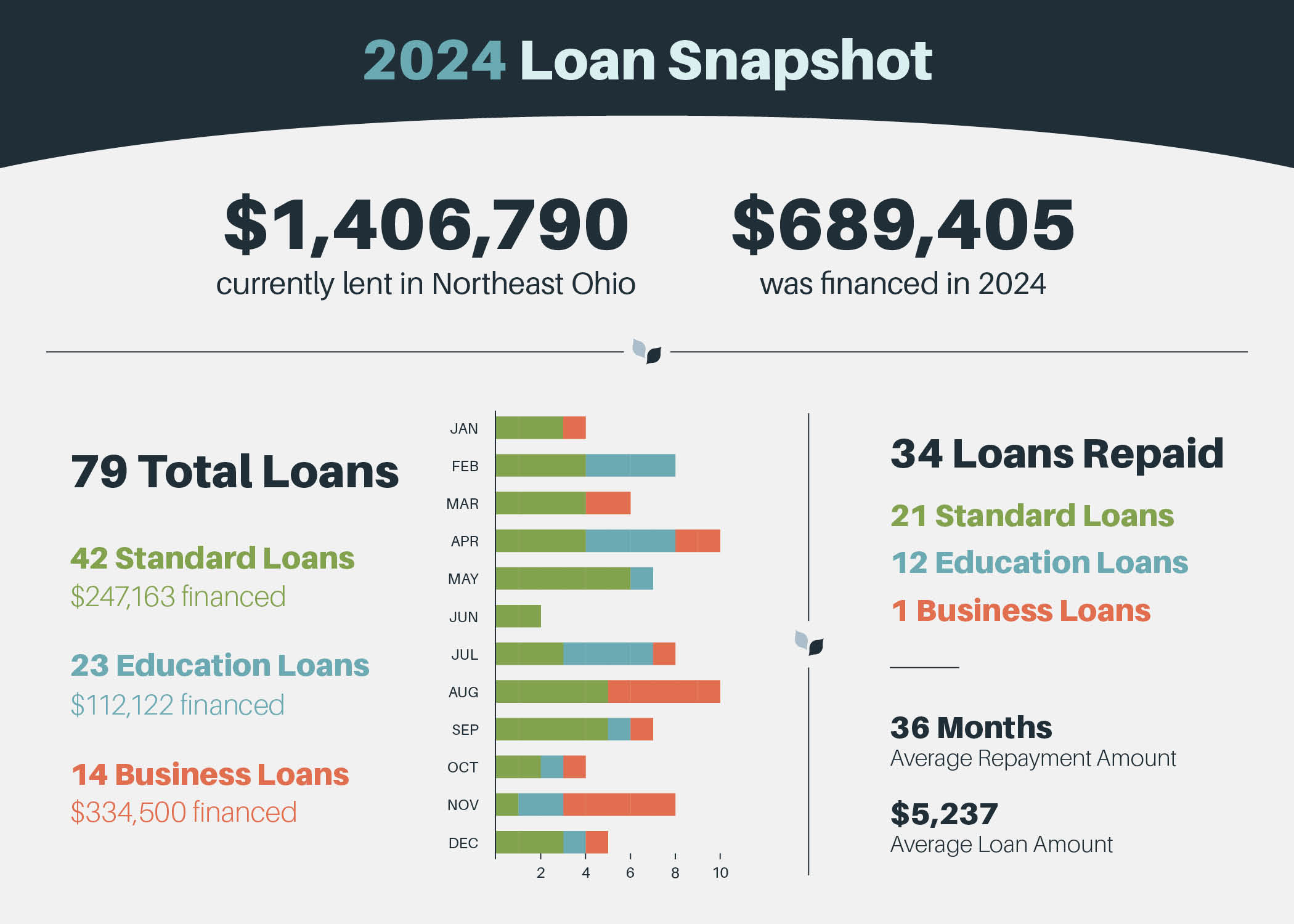

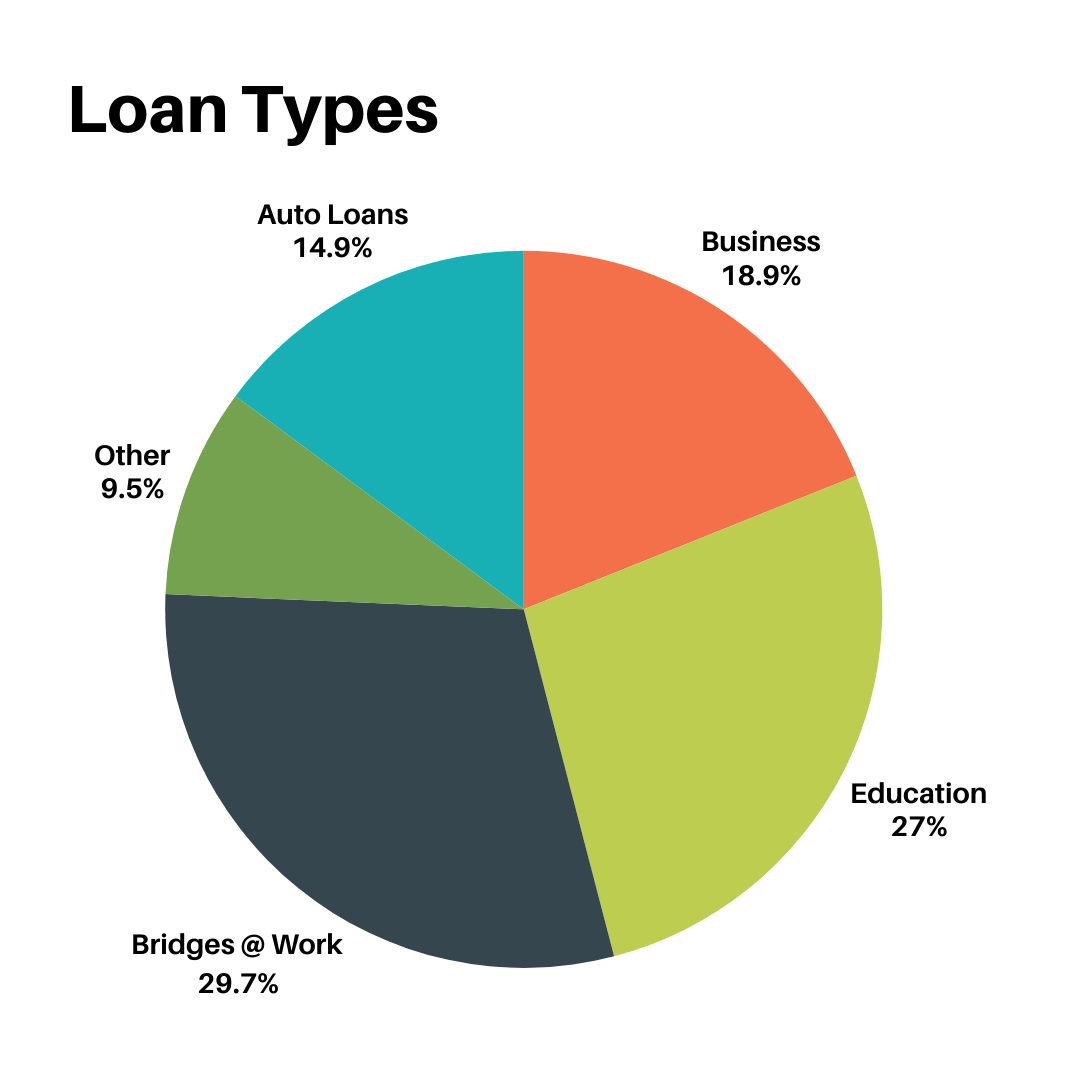

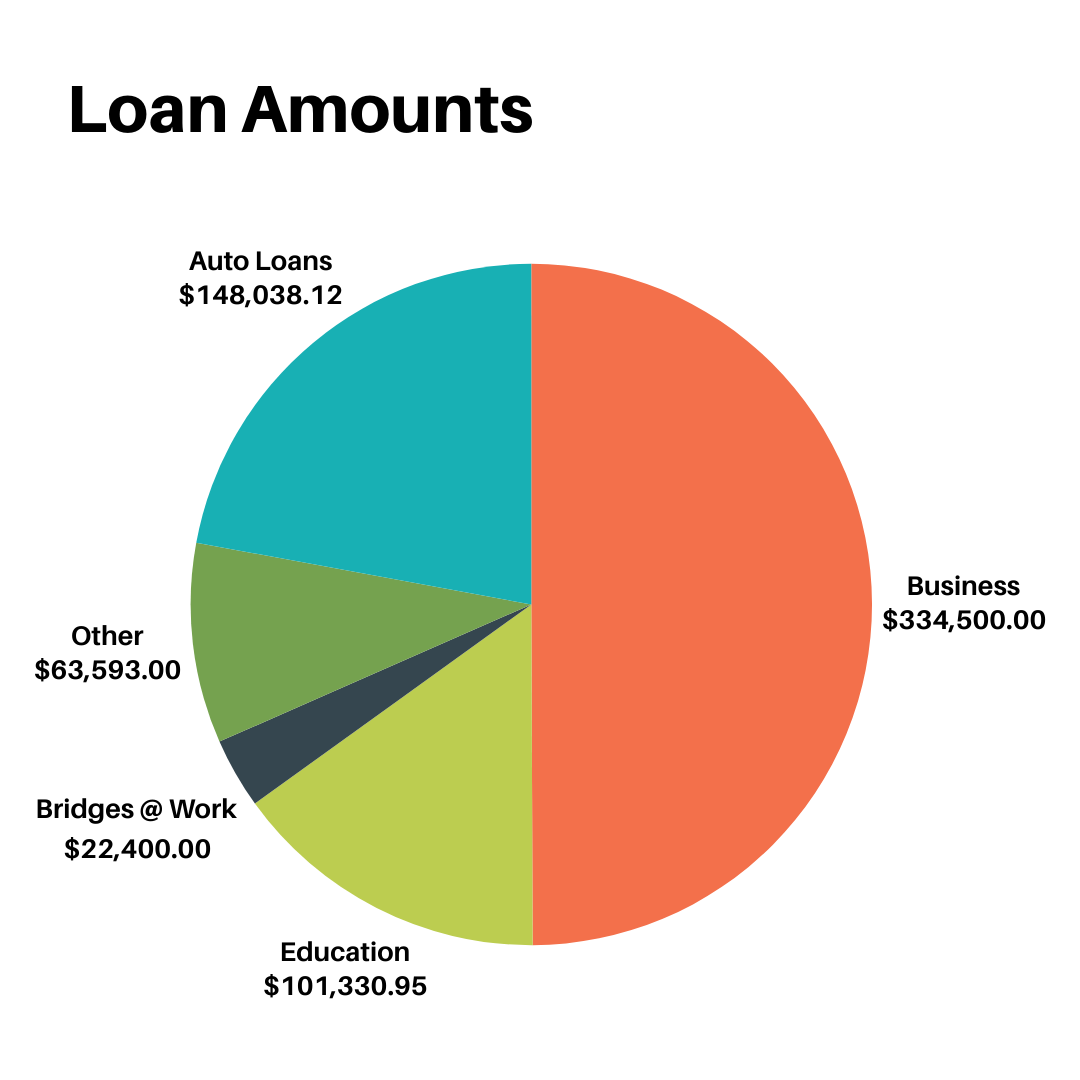

In 2024, we continued to serve the Northeast Ohio region, covering 31 cities. We made 79 loans totaling $689,405 to the community. We are so incredibly grateful to have worked with our borrowers to get them one step closer to financial wellness. There has also been incredible growth in our business lending. We anticipate that it will continue to grow in 2025!

Five of our 14 business loans were given to new business owners opening up in CentroVilla25. These loans were to help them settle into their new homes and get their kiosks up and running so they could attract new clientele in a new space. The building is already buzzing with activity and we are proud to be a small part of building such a vibrant location.

Ten of our Standard Loans this year were auto loans. While we have indefinitely paused auto lending, we are happy to have assisted so many individuals in securing transportation. To learn more about our decision to pause auto loans, read our February blog post, “To Loan or Not to Loan?… The Future of HFLA Auto Loans.”

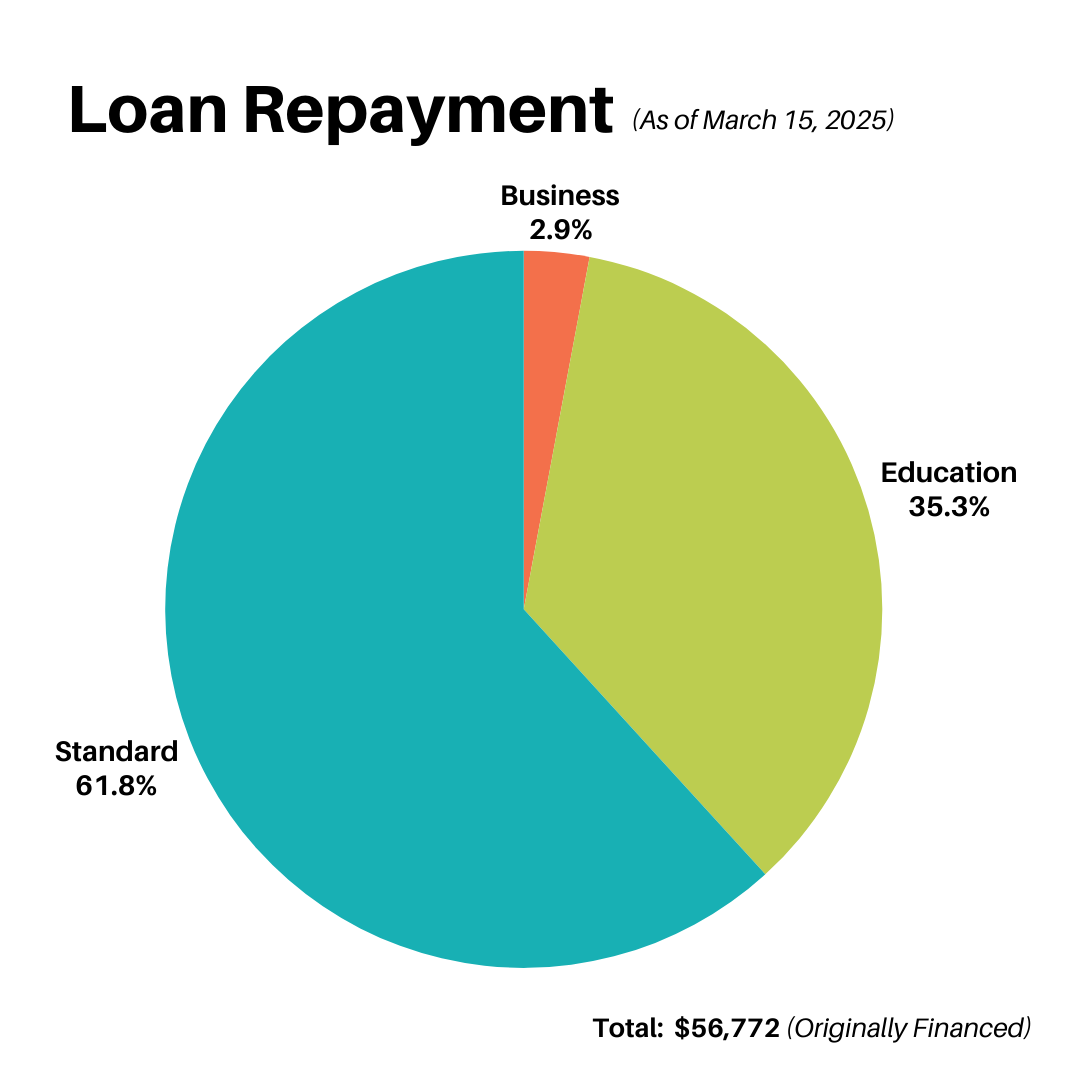

As of March 15, 2025, we have 239 active loans with $1,406,790 in the community! In the first quarter of 2025, thirty-four borrowers made their last payment to HFLA, having paid their loans in full!

We are beyond proud of all of our borrowers who have been able to finish paying their loans and are living in a different reality than when they first applied to us! The average repayment rate was 36 months, with the average loan amount being $5,237. Being one step closer to financial success is always something to celebrate. Once again, congratulations to our amazing borrowers, and we can’t wait to see what the future holds for them.

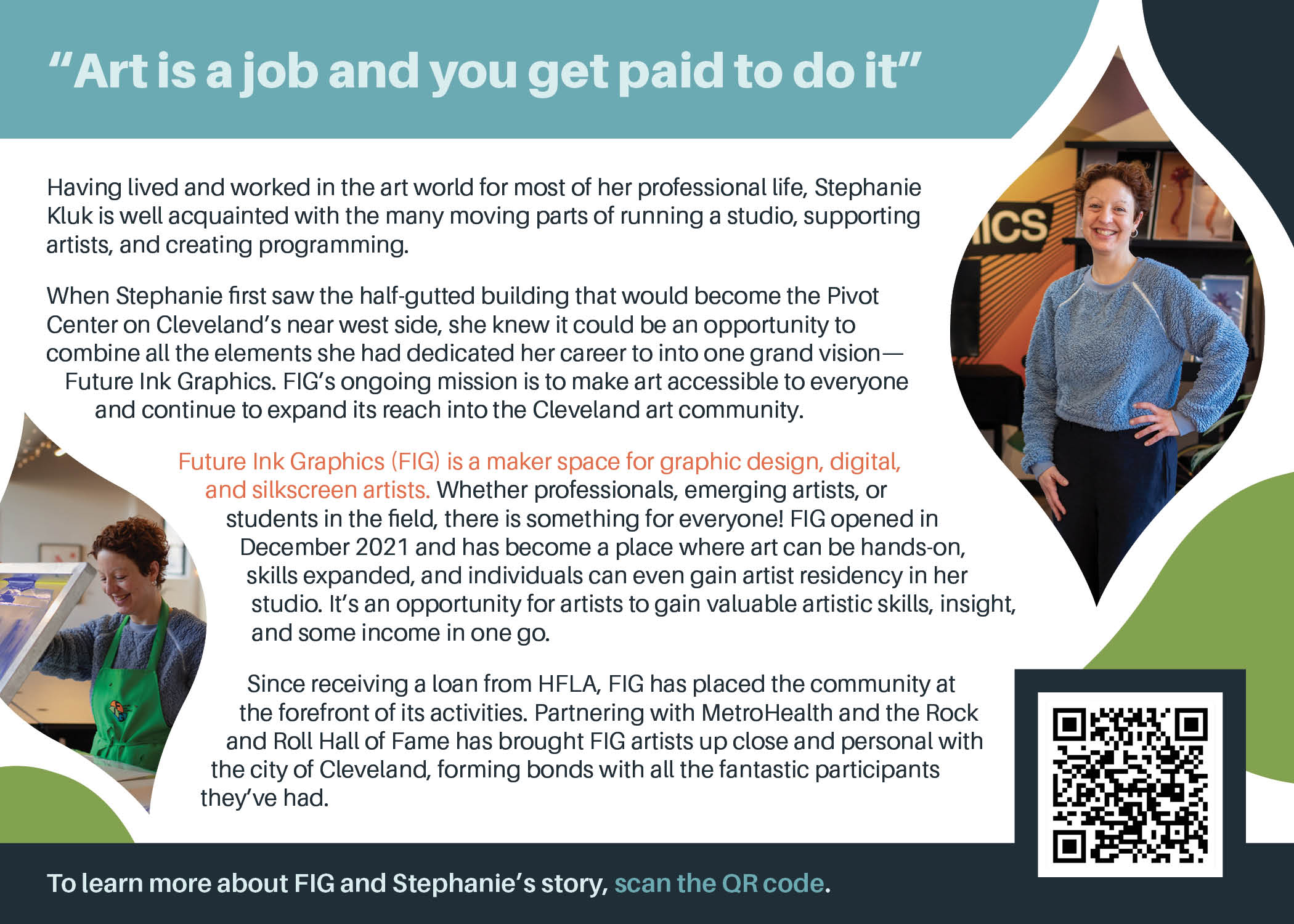

Art has always been deeply entrenched in Stephanie Kluk’s life. Whether creating programming for Chicago artists, supporting students in the Cleveland Metropolitan School District in art education, or cultivating an art co-op, Stephanie has always found herself in creative places.

So when she saw the raw space that eventually became the Pivot Center, she knew this was where life was leading her next.

Using her previous experience and the close relationships she had cultivated over the years, FIG (Future Ink Graphics) was born. JumpStart, a Cleveland-based nonprofit that helps entrepreneurs turn their dreams into reality, referred her to HFLA, and she was able to start her women-owned art enterprise.

Stephanie has created a space for underrepresented communities, amplified artists through FIG’s artist residency program, and showcased their work the year after their residency has ended. From February 14th to April 11th, this year’s gallery exhibition, “Women Who Print,” celebrates contemporary female printmakers, with a focus on silkscreen printing.

FIG has three major components: Advocacy, Education, and being a Maker Space. In-house FIG hosts workshops, allowing people to get hands-on with the art around them and create something they can proudly call their own, regardless of skillset. Collaboration with local youth programs connects them with over 600 students a year, making art something tangible rather than a skillset reserved for those who already have talent. FIG also rents its space for others to come in and take advantage of the resources FIG has available with the support of the on-site staff.

Their prime location in the Pivot Center has also majorly helped the organization and its artists. Being one of the only privately owned small businesses makes it a bit of an oddball, but that doesn’t stop all the Pivot Center residents from solidifying their community and commissioning FIG for their digital arts and screenprinting services. Artists in FIG’s community gallery also benefit from the exposure that the Pivot Center brings; their proximity to the Cleveland Museum of Art’s Community Art Center usually leads to some spilling over between the two art spaces.

Most of FIG’s work is out in the community, partnering with MetroHealth and the Rock and Roll of Fame to bring art to people, programming attracting about 1000 people yearly. Word of mouth and personal referrals have been incredibly successful in getting the word out about her space, but she hopes to see further investments in small organizations and more Clevelanders patronizing local businesses. Being involved in the community supports the city, business owners, and their teams and builds lasting relationships.

To Loan or Not to Loan?...The Future of HFLA Auto Loans

Photo by Tim Mossholder on Unsplash

To Loan or Not to Loan?...Auto Loans

What does car ownership look like in 2025? We are not floating around in flying cars like we were promised. In fact, buying and owning a car feels more challenging and complex than ever. Between skyrocketing (pun intended) costs and the interest rate rollercoaster, many people do not know where to begin. In 2022, HFLA launched an auto loan to help simplify the process and make owning a car more accessible. After two years of this loan product, we found more questions than answers. Can we keep up with demand? Do these loans align with our lending principles? Can we manage the mechanics of these complicated loans?

Bloomberg reports that car repossessions increased to 23% in 2024, up 14% from the 2019 pre-pandemic levels. Why is this happening? During the pandemic, lenders were more lenient with payment schedules, giving people some flexibility during those unprecedented times. Times have become… precedented again. Inflation has shifted, and monthly car payments have gone to near-record highs. “The average interest rate for a new car is currently 7.3%, and for a used car, it’s 11.5%, according to Edmunds data. That means, on average, monthly bills are now $739 for a new car and $549 for a used car.” In June 2024, over 5% of auto borrowers were at least 2 months late.

Generally speaking, everything is getting more expensive. The cost of living has increased across the board. The Bureau of Labor Statistics reports that the Consumer Price Index has risen 2.7% for the past 12 months (ending in November 2024), with food, shelter, and energy indexes all rising. With personal budgets becoming tight and wages stagnant, there is increased distress on the consumer. People have to choose between rent, food, and utilities. As expenses become overwhelmingly inflated, auto payments become deprioritized, which used to be the priority due to fear of repossession.

Where does HFLA fit in all of this?

In January 2022, HFLA began offering auto loans intended to support the purchase of automobiles. Our auto loans went up to $15,000–larger than all of our other personal loans and had a monthly payment of no more than $250.

Auto loans have allowed people to purchase a car. But is this just pushing off the inevitable? Cars are expensive investments, and most people’s livelihoods revolve around having one. Cars have become a modern essential, whether people travel to and from work, run crucial errands, make appointments, or work with their car (Ubering or Dooordashing).

But have people become burdened by the same thing meant to assist them? This question led us to pause our auto purchase loans in the Fall of 2024.

One of our borrowers, Pat Nolan, is a perfect case study to follow our position on auto loans.

Nolan learned about HFLA after the Western Reserve Land Conservancy bought his home in the Euclid Beach Mobile Home Community. This decision “felt like a rug had been pulled out from under us,” Nolan explained, recounting the community banding together to ensure that their neighbors were treated fairly and given just compensation. Some people, like Nolan, had been in this neighborhood for over 10 years and were not expecting this sudden lifestyle shift. HFLA partnered with the Western Reserve Land Conservancy, making loans to those who needed a little extra to smoothly transition to a new location.

Having to move put distance between him and his mother, who still lived in the area. Our auto loans seemed like a perfect solution.

“Cars are great when they work, and they're a pain when they don’t,” Nolan states. Anyone who has owned a car knows that sentiment well. Nolan purchased a used car and, within a few months, the transmission blew out. Nolan returned to us to increase his loan and beagle to afford the necessary parts. Because he had not borrowed the maximum amount available, we increased his loan, and he received a 3-year unlimited-mile warranty on his transmission.

But cases of unexpected car troubles happened incredibly often to our other borrowers.

When it comes to owning a vehicle, there are many moving parts: insurance, car payments, parking fees – without even factoring in unexpected (but inevitable) expenses, like flat tires, busted transmissions, and general damages that occur when simply operating a vehicle.

While people are paying off their car loans, a lot can happen during that period. The average auto loan term is 68 months, and plenty of incidents can happen during that time. This is what makes offering auto loans so tricky. We pride ourselves on helping people get on the path to financial stability. However, many of our borrowers could not get their footing, even with their loans.

In the situation where someone can no longer pay their auto loan, where does that put us? We are not in the business of repossession; it goes against the very core of our mission. We look to help our community members, not become a threatening presence that can take someone’s livelihood away. Our loans are intended to stabilize individuals and families and help them through treacherous financial times. These loans were increasingly putting people in precarious financial positions.

We continue offering interest-free auto repair loans and refinancing loans up to $10,000. We value our role as a vital community resource. Although our auto purchase loans didn't go as expected, we're looking ahead and exploring new opportunities to better serve Northeast Ohio.

Unbanked and Underserved: The Importance of a Bank Account

Nationally, more people than ever are opening bank accounts. Opening and maintaining a bank account can be one of the most effective ways to achieve your financial goals, including increasing your credit score, buying a house, or just finding financial security. In 2023, the US’s unbanked rate dropped to 4.2%-- the lowest level since 2009. Northeast Ohio, however, is seeing a different trend. The unbanked rate in NEO increased from 2.0% in 2021 to 5.4% in 2023–an increase of over 3%!

There are a variety of reasons why people avoid mainstream financial institutions:

- Lack of trust: Many groups have been victims of racist and exclusionary practices by the mainstream financial industry that have systematically left them out of the system.

- Minimum Deposit: Until recently, most banks required a minimum amount to even open an account and maintain the account, making them inaccessible for many people with inconsistent income.

- Fees: With inconsistent income, many people face high overdraft and/or administrative fees, making traditional banking too costly.

Groups that are typically left out of traditional banking tend to be “lower-income, less-educated, Black, Hispanic, disabled, and single-parent households.” Households of color are five times more likely to be un- or under-banked compared to white households.

Those unable or unwilling to participate in the mainstream financial industry have few other options. For most, the only option is to rely on predatory services that require high fees and implement exorbitant interest rates, forcing people to pay up to 5% of their income to access their own money. This could add up to over $40,000 over one’s lifetime. These predatory lenders send people into a cycle of debt that becomes untenable and leads people further into financial instability. Even those who may have a bank account can be considered “underbanked” when they still rely on nonbank financial services, such as check cashing services or pawn shops, and therefore are still vulnerable to exploitative practices.

This is not inevitable. Bank accounts provide many opportunities in the modern economy, like establishing and building credit, avoiding fees to access their money, and growing wealth.

The Consumer Financial Protection Bureau under the Biden Administration has recently ruled to crack down on bank overdraft fees, offering banks the option to either have a flat $5 fee, cap the fee to cover costs and losses, or “charge any fee but disclose the terms of the overdraft loan they extend to customers the same way they would for those of any other loan.” This new rule can save consumers $5 billion, or roughly $225 per household. Many banks have stepped up to the challenge of making mainstream banking more accessible. Working with the Bank On National Advisory Board and Coalitions across the country, like the ones in Cleveland and Summit County, banks have lowered the barriers to banking. This includes limiting fees, removing minimum balance requirements, and working with community partners to connect people to accounts.

HFLA of Northeast Ohio can provide a third option.

HFLA has offered 0% interest loans for 120 years. Rather than continuing to spiral into a perpetual cycle of uncertainty, our loans give people the chance to stabilize their financial situation and start on the path of rebuilding. Our applicants are individuals who often get turned away from traditional banks. They are seeking help to address a need like a required home repair, medical bills, or to get out from predatory loans. We ensure that our loans are accessible, affordable, fast, and fair. Our loans are not “easier” to qualify for, but we work to remove barriers to help people get much needed capital. People are so much more than a 3-digit credit score. We try to understand the whole picture and prioritize repayment history and budgeting plans when considering their application.

There are still some barriers. All of our loans require a cosigner or guarantor. As a nonprofit, we rely on our loans being paid back to continue our work. Co-signers and guarantors provide a level of security to ensure that the loan is paid back in full.

Our staff will work with an individual through the complete repayment of the loan. Successful repayment is just as important to us as their loan payments go back into our revolving loan fund to help fund someone else’s loan, continuing the cycle. Our hope is that you come to HFLA for your first loan and through our support (and credit reporting) you will be able to access the mainstream financial system for your second loan.

With unbanked rates increasing in the Northeast Ohio area, support is needed now more than ever. Since 1904 HFLA has created financial opportunities for its community. If you want to support HFLA’s mission, you can donate here to assist with operational costs to keep our organization going. If you know someone who might benefit from an HFLA loan, please visit us at interestfree.org or contact us at team@interestfree.org.

To learn more about this topic, take a look at the Federal Reserve Bank of Cleveland’s FedTalk: “A Continued Discussion on Financial and Payments Inclusion”.

Hear Our Stories: 2020 Loan Recipients

Hear Our Stories: 2020 Loan Recipients

Each year we highlight a group of HFLA loan recipients who embody the our mission through their personal story and character. This year, we have highlighted a group of extraordinary women, who through strength, resiliency, and resourcefulness, overcame obstacles and moved closer to achieving their dreams. HFLA is proud to have been a part of their journeys as a resource that provided the support they needed at a pivotal point in each of their lives.

The Carmens

HFLA helped three generations of Latina women on Cleveland’s near west side regain control of their finances.

After Carmen Vazquez’s husband passed away, her family struggled to adjust to their new financial situation. She, her daughter, and her mother began living together and supporting each other financially. However, when critical repairs needed to be done to their home, Carmen’s family did not have enough saved to cover the expenses, and they were unable to obtain a bank loan for the repairs.

HFLA first met Carmen during open office hours at one of our partner organizations, Metro West CDO. Jose Colon of Community Financial Centers was working with her as her financial coach. He suggested that Carmen apply for a small, interest-free loan from HFLA to help consolidate some high-interest credit card debt that accrued after her husband’s passing, which would help her qualify for a home equity loan later on. Carmen and her mother applied for the loan, and her daughter stepped in to guarantee the loan for them.

HFLA’s interest-free loan allowed Carmen to move the credit card debt onto a short term, interest-free repayment schedule. She continued working with her financial coach and developed a very disciplined budget with new strategies to help her stay on top of her finances. Carmen no longer has high-interest credit card debt holding her back from accessing the funds she needs to repair her home and will soon re-apply for a conventional home equity loan through her bank.

Patti McSuley

HFLA helped a breast cancer survivor make a safe space for women battling cancer to feel beautiful.

Patti McSuley had been working as a cosmetologist for only a few years when she was diagnosed with breast cancer in 2008. Medical bills quickly piled up from her treatment and, like many Americans, Patti filed bankruptcy due to the insurmountable debt. After the experience, Patti began Compassionate Wigs, a wig salon for women going through chemotherapy or hair loss.

At its start, Patti’s business was a room within a larger salon. She realized that her business would quickly outgrow this space due to the amount of wig inventory needed to serve her clients. As she began to look for a new location for her business to grow within, she also began searching for funding sources. Patti received a small grant from the Youngstown Business Incubator and a low-interest loan from the Mahoning Valley Economic Development Corporation to secure her space and make the necessary renovations.

Unfortunately this funding would not become available for Patti for a few months and she needed capital immediately to make the salon operable and obtain needed inventory. Because of Patti’s previous bankruptcy, she was ineligible for a traditional small business loan. It was at this point that Patti was referred to HFLA by the Youngstown Neighborhood Development Corporation as a way to increase her stock of wigs, wig cleaner, and other specialty products that she needed for her new storefront business.

Today, Patti is the proud owner of Salon 224 in Boardman. She provides traditional salon services and operates Compassionate Wigs out of the salon in a private room large enough for women to come in with their own support team as they work with Patti to choose and style their wig. HFLA’s loan helped Patti achieve her dream of making each woman look and feel her best during cancer treatment,

Chika Morkah

HFLA was able to help an international student achieve her educational goals.

Chika Morka is an international student from Nigeria who came to the U.S in the Spring of 2016 to further her studies at Cleveland State University. After her arrival, changes in laws made it impossible for her to receive money from her home in Nigeria, stranding her one semester away from graduation with no way to pay her tuition. Chika was introduced to HFLA by a classmate who had received an HFLA education loan previously. This education loan allowed Chika to not only pay for her tuition and register for her last semester for her at CSU, but allowed her to remain in the U.S. on her student Visa. Without this funding, Chika would not have been registered for classes and would have been forced to return home as she would have been out of compliance with her Visa.

Chika finished her Master’s of both Psychology and Diversity & Inclusion Management in Spring 2020, and is currently pursuing a PhD in Global Leadership and Change.

“I was ecstatic when I received my education loan. I was worried that I wouldn’t qualify because I am an international student, but I was relieved and grateful. It was a life-changing moment for me. I have been spreading the news in my own little way to tell people about the positive impact an organization like HFLA is having in the Northeast Ohio community.” – Chika

DeLane Anthony-Loggins

HFLA helped a small business stay on track during the COVID-19 pandemic.

DeLane Anthony-Loggins is an MBA graduate, licensed esthetician and the small business owner of The Wax Bar originally located in Woodmere Village. She opened The Wax Bar and Beauty by LA at 25 years old. Through hard work, she has built her business to nearly 3,000 clients over 6 years.

In March when the COVID-19 pandemic hit and the state of Ohio mandated closures of “non-essential” businesses, including salons and spas, DeLane was forced to close. It could not have come at a worse time–she was in the middle of planning her salon’s expansion and relocation. DeLane began the process of expanding her salon several years ago. The abrupt and indefinite closure of her business left her at a crossroads: should she move forward with her expansion plans or put her dream on hold? DeLane initially decided to put the move on hold. Fortunately, a few weeks later, the landlord of the storefront where DeLane wanted to relocate the business sent her information on HFLA’s interest-free loan.

DeLane’s Small Business Emergency Loan allowed her to order PPE and supplies to prepare herself and her business for reopening. This interest-free loan also allowed her to move forward with her plans to move and expand her business. “There’s always a silver-lining, even when you least expect it. HFLA during the pandemic was my silver-lining.” – DeLane

News 5 Cleveland: Local non-profit helps people of color overcome financial roadblocks

CLEVELAND — A local non-profit is looking to break down the barriers that keep people of color from accessing capital.

When Angela Sharpley set out to secure the funding she needed to expand her business, she initially found some resistance.

“I was told that there was no help for me out here,” said Angela Sharpley, small business owner.

It was the message she heard from a lender right out of the gate.

“They never got to my credit, so that’s the only thing they had to go off of was who I was,” said Sharpley.

When intentionally placed roadblocks prevent people of color like Sharpley from accessing the cash they need, HFLA of Northeast Ohio steps in to help bridge that divide.

“Our mission is to help people that don’t have access to fair financial tools,” said Michal Marcus with HFLA of Northeast Ohio.

For more than a century, the non-profit has been providing interest-free loans to those who might otherwise go without just because of who they are.

“How race and racism play out with regards to access to capital and investment absolutely needs to be at the forefront,” said Mark Joseph, CWRU professor of community development.

Along with intentional decisions based on appearance, Joseph said there is implicit bias at play.

“We have something in our perception or mindset that would lead us to believe that someone who is African-American, a person of color, is less creditworthy,” said Joseph.

Along with racism, not knowing where to find resources often keeps access to funding out of reach. Joseph said that includes “understanding where you can go for loans, for investment, or capital.”

It’s a similar issue Sharpley said she faced when starting out.

“You don’t have a road map to know where to go,” said Sharpley.

When people do finally find that direction, Sharpley hopes they have an equal chance to get the cash they need to invest in their community.

“I would like for the playing field to be made fair,” said Sharpley.

On Wednesday night, HFLA will tackle these and other topics during a virtual event called “Fostering Economic Equity: Fixing the Racial Imbalance in Consumer Finance.

“More corporations, banks, and larger financial institutions need to step up with fair financial tools,” said Marcus.

The online conversation begins at 5:30 p.m.

It is free and open to anyone in the community.

You can register at Interestfree.org.

Watch the full event and panel discussion, Fostering Economic Equity: Fixing the Racial Imbalance in Consumer Finance, on our website here: www.interestfree.org/events/fostering-economic-equity/

What can HFLA of Northeast Ohio do to foster financial equity?

Dear Supporters,

It feels like such a long time ago that the stay at home order was declared, schools were closed, businesses shuttered, and we saw our own normal operations swiftly shift to high-demand, touch-free, and remote procedures. Our state has moved forward since these mandates and Ohioans are trying to create some sense of normalcy within this chaotic period in our American history. Despite the national pandemic, protests continue to fight for change and equitable practices within our country and government systems, leaving HFLA of Northeast Ohio to confront a very important question:

What do we do to fight for change and equitable practices within the region we serve?

As staff and board members, we have an idea where to start, but we want to hear the input of our supporters, our clients, and our entire Northeastern Ohio community.

HFLA’s interest-free financing options are available to those who are unable to access conventional forms of financing. This inability to access bank or credit union loans is often due to systemic barriers that prevent those circling poverty from achieving financial security. Some of the most underserved populations in our country in terms of access to finance and capital are African Americans and Latinx communities.

Within our Northeast Ohio region, HFLA’s loan disbursement includes 52% to Black/African Americans individuals and 9% to Latinx borrowers. HFLA has smaller percentages of loans going to other demographic groups, including 3% to borrowers of Middle Eastern descent, 2% to Asian/Pacific Islander, and 2% to two or more races. Our business loan portfolio is made up of 62% business owners/entrepreneurs of color and 42% of all business loans are made to BIPOC (black, indigenous, and people of color) women (data retrieved August 2020).

HFLA has always served those who were left without equitable financial resources. Whether that means serving European immigrants in the early 1900s, or serving communities struggling to overcome economic barriers today.

This fall, on October 21st, 2020, we will take a step towards confronting the systemic inequities in the financial system with an online panel discussion with area leaders titled:

Fostering Economic Equity: Fixing the Racial Imbalance in Consumer Finance

Please stay connected with us as we provide more information and updates. This will be an honest and enlightening discussion on what the current situation is and what changes can be made to make a better future for all Northeast Ohioans.

Together we can replant Northeast Ohio.

Savings Strategies for a Tight Budget

While HFLA of Northeast Ohio is here to provide interest-free loans to those who need them, the ultimate goal is to not need one. How? Meet your new best friend – a Savings Plan.

Ideally, a savings account or emergency fund can give you the cash you need in times of crisis without relying on loans or cash advances.

Unfortunately, we are all currently stuck smack in the middle of a global health crisis. A crisis that is having a major impact not only on our daily lives and health, but especially on our income and personal savings. Fortunately, many of us will be receiving a tax refund that can give our finances a boost. While cash during this crisis may feel like the answer to all your problems right now, it is important to use this money wisely and to think long-term. This can help you take effective steps towards a long-term savings plan to get you and your family through this pandemic and find financial security in the future.

What is an Emergency Fund?

The rule of thumb for an “Emergency Fund” is 3 months worth of living expenses in your savings account. The reality however, is that many Americans struggle to come up with $1,000 in an emergency. We at HFLA do feel that it is crucial to develop an emergency fund however, it doesn’t have to happen overnight. A slow and steady strategy will allow you to gradually and reasonably work up to your savings goals.

Observing prudent savings strategies now will make a world of difference once we all come out the other side of the COVID-19 Pandemic.

Take Advantage of Your Tax Refund in 2 Ways

Luckily for many of us, income tax refunds can provide some much needed “bonus” cash that can be used to stabilize your finances.

1. Add one month of living expenses to your savings

You just worked out your monthly expenses, so if you can, add that total to your savings now with your tax refund!

Remember to include: rent/mortgage, food, utilities, car note, minimum credit card payments, and insurance. Can you take this amount out of your tax refund? If yes, put that into your savings IMMEDIATELY! If not, try to put a portion of that into your savings and strive to save the rest up throughout the year.

2. Catch up on collections or due balances

Review your credit report on AnnualCreditReport.com to see if you are behind on any collections or any accounts.

Use your tax refund to give your credit a boost and get caught up on things that are too big to tackle all at once. Consider speaking to a financial coach or financial counselor to help you with clear goals on what debts to tackle first.

3 Tips to Start Saving Without Breaking the Bank!

Some simple ways to start reaching your financial goals, even on a tight budget.

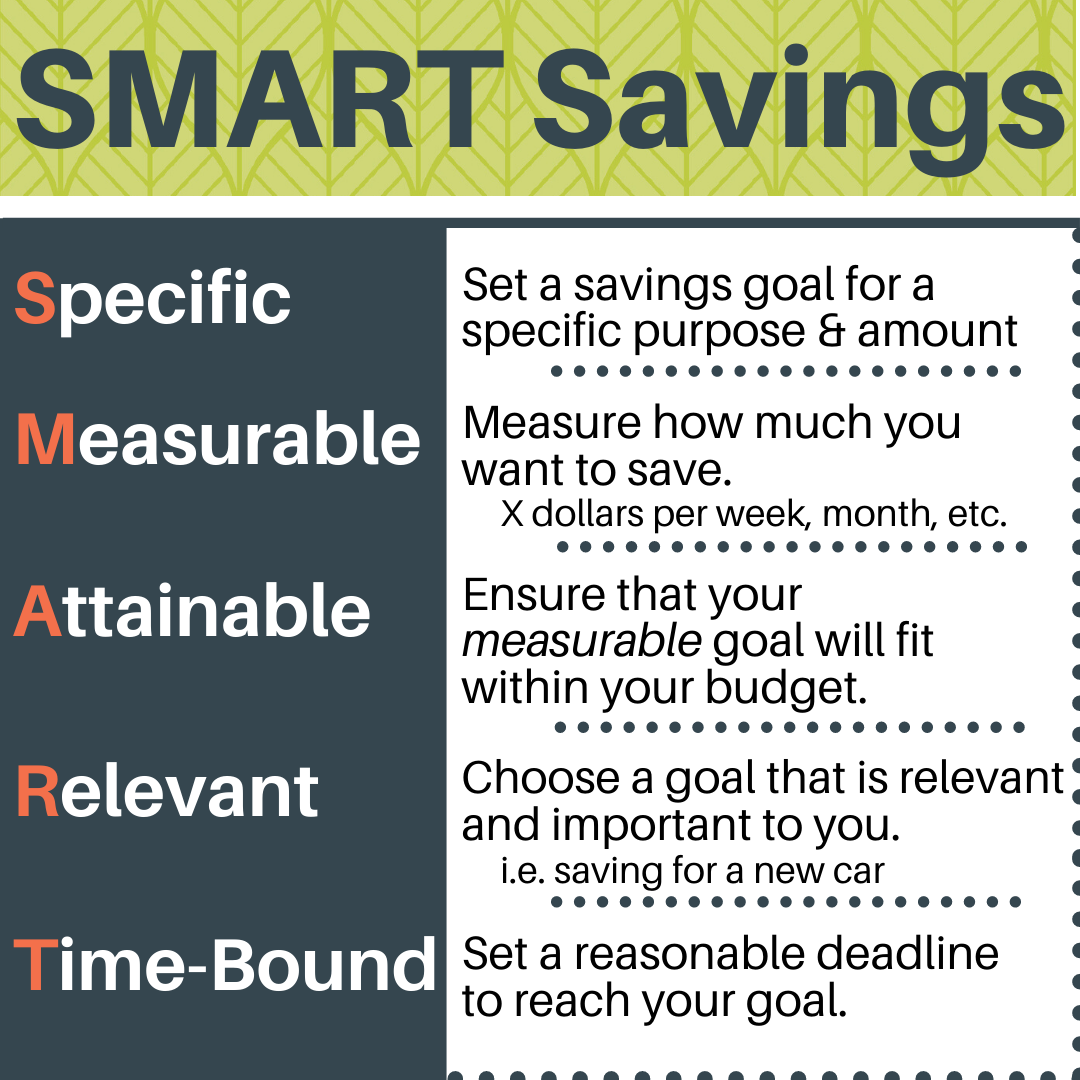

1. Make a SMART plan for your savings goal

Let’s say you want to save up one month’s living expenses, equaling $500, in one year.

Your specific goal is to contribute one month’s living expenses to savings measured to be $500 total. Your regularly measured goal equals $42 a month over 12 months. You check, “Is this goal attainable with my current income and expenses?” If yes, stick with it! If no, lower the measurable goal to something that fits within your budget. You ask, “Is this goal relevant, will it help me in the long run?” Yes! You will eventually have one month of living expenses that could be relevant during an emergency! You set a goal date of 12 months to keep your goal time-bound.

Once you’ve achieved one SMART goal, make another! Check out this worksheet from Consumerfinance.gov and create your own.

2. Set up direct deposit and “pay yourself” first

If you haven’t already, set up direct deposit to get your paychecks into your bank account quickly and safely.

Every time you receive a paycheck, “pay yourself” first! Take a predetermined amount from your paycheck and deposit it into your savings account before spending anything! By contributing a small portion of every paycheck into your savings account, you are growing your savings fund at least once a month without having any time to to spend it. Some banks also offer automatic savings that directly takes a designated amount of your paycheck each time. Even $5 a paycheck can go a long way when you stick with it!

3. Become a “Brown-Bagger”

Making the change from buying to packing lunch is definitely a lifestyle commitment, but one that can save you thousands of dollars annually.

One cup of coffee a week can be anywhere from $2-$5 dollars. That alone adds up to at least $100 a year! Getting takeout can be inexpensive, but still at least $5 a day. Make your coffee at home, plan your meals the day before, and put that money back in the bank! Every time you feel the urge to buy food or coffee instead of making it yourself, total up what you are about to spend and put that money into your savings instead. You’ll be amazed to see how much you would have spent!

And most importantly, don’t touch your savings account!

Keep your hands out of your savings account as much as you can. Treat it like it is money only to be spent in an emergency. Schedule dates where you check on it’s growth. You’ll be surprised with how much you’ve put away in such a short time by keeping your hands off and eyes out!

About HFLA of Northeast Ohio

HFLA of Northeast Ohio was founded in 1904 with $501 donated by Charles Ettinger, Morris Black, and their friends to help European refugees settle and begin productive lives in this country. They believed – as we do now – that if you give someone a chance to succeed, they will pay it back and we can continue this transformative cycle. The same principle guides the organization today. By providing interest-free loans to individuals, families, and small businesses in the Northeast Ohio area, we are able to help people help themselves. The association has drastically increased its lending capital in the past few years from individual gifts, bequests, endowments, foundation grants, memorials and honorariums and is now operating with a loan fund of over $1 million. HFLA is a 501(c)3 non-profit organization. Learn more about HFLA.

Get involved and stay up to date by subscribing to our quarterly newsletter or following us on social media.

Avoiding Financial Scams During COVID-19

Avoiding Financial Scams During the COVID-19 Pandemic

We are all trying to navigate a “new normal” in our daily lives. It has been inspiring to see how many individuals, small businesses, and families are coming together to lift up their community and strive to make a difference in the lives of those who are facing difficulties.

Yet, despite this new “distant” community connection, we must still be wary of scams that try to take advantage of the vulnerability and generosity that we see today.

We have some basic tips to keep yourself safe from scammers during these times.

3 Essential Rules:

- Do not give your Social Security number, any bank account numbers, or credit/debit card numbers to someone over the phone. You have no way of guaranteeing the identity of whoever is on the other line.

- If someone solicits you for something that you’ve “won,” an investment opportunity, or a “limited time offer,” walk away. If it seems too good to be true, IT IS.

- If you are looking at financing or loan options, look for the Truth in Lending Act within the loan documents. If you are unable to find reasonable interest rates on a personal loan, contact HFLA of Northeast Ohio.

From the Ohio Department of Health:

- Robocalls – Never provide personal information such as social security numbers, bank account numbers, or credit card numbers to automated messages. If you think that the message is legitimate, call the organization via a local branch number and speak to a representative.

- Emails from the Federal Centers for Disease Control and Prevention (CDC) – Legitimate information is available from the CDC via coronavirus.gov and from the Ohio Department of Health at coronavirus.ohio.gov.

- Federal stimulus checks – Updates can be found on the Federal Trade Commission website: https://www.consumer.ftc.gov/blog/2020/03/checks-government – You WILL NOT need to pay money in order to receive your stimulus check, you WILL NOT need to provide social security numbers, bank account numbers, or credit card numbers. DO NOT GIVE THIS INFORMATION OUT.

- Research charities before donating (that includes us!) – Find a database of registered charities on the Ohio Attorney General’s website: https://charitableregistration.ohioattorneygeneral.gov/Charities/Research-Charities.aspx

If you suspect unfair or deceptive sales practices, contact the office of Ohio Attorney General Dave Yost: www.ohioprotects.org – 1-800-282-0515

Keep up to date with the latest scam alerts on the Federal Trade Commission website: https://www.consumer.ftc.gov/features/scam-alerts