Cleveland Jewish News: HFLA Offers Expedited Loans

HFLA offers expedited loans up to $1,500 for those impacted by COVID-19

After Gov. Mike DeWine closed all Ohio schools March 12, the Hebrew Free Loan Association Of Northeast Ohio didn’t waste time enacting an expedited emergency loan program, which loans individuals up to $1,500 interest free.

The next day, the Beachwood-based organization received 60 calls, and the number only increased after bars and restaurants were ordered to shut down in the days following.

The loans are meant for Northeast Ohioans who have been impacted in some way by the COVID-19 pandemic, whether that means loss of income, a sudden need for funds to pay for child care or another need.

Executive Director Michal Marcus said the organization typically requires a guarantor on loans it offers up to $10,000. For the expedited $1,500 loans, all that’s required to apply is an application and documentation.

“These are being written directly to individuals because we know if you are a restaurant worker, or in some type of service industry that isn’t working now and you aren’t getting income, you are going to need that money to buy groceries, you are going to need that money to pay a babysitter,” Marcus said. “There are needs where we can’t write it directly to the source of need.”

In the first week of expedited loans, HFLA was able to provide same-day turnaround on the loans once an application was complete and a promissory note was signed. HFLA is using DocuSign so the loans can be signed electronically.

Marcus said because her organization is now working remotely, checks could take three to five days to appear for loans because “it’s coming directly from the bank and we are trying to have as little physical touch as possible.”

In the first week of the program, Marcus said she saw “a lot of anxiety” around the impact of the pandemic and the unknown end date.

She said the first person to receive an emergency loan was a single mother working at University Hospitals who now needs to pay for child care since her children are out of school. More loans went to those in the restaurant industry, and she’s been contacted by substitute teachers who don’t get paid if they aren’t in school.

The HFLA expedited loans are generally targeted toward individuals, although Marcus said small businesses are also likely to suffer and need larger loans.

Marcus also said she was grateful for HFLA’s supporters who have reached out to ask how they can help the organization continue on its path.

“That has been kind of heartwarming to know – seeing how much people care,” she said. “And we do need it, our funds will run out.”

For more information, visit interestfree.org.

What is Predatory Lending?

I Get It: Payday and Online Business Loans are Bad – But I Need One!

As a nonprofit that provides interest-free loans, too often we see that our applicants are burdened by what we consider “predatory” loans and credit cards.

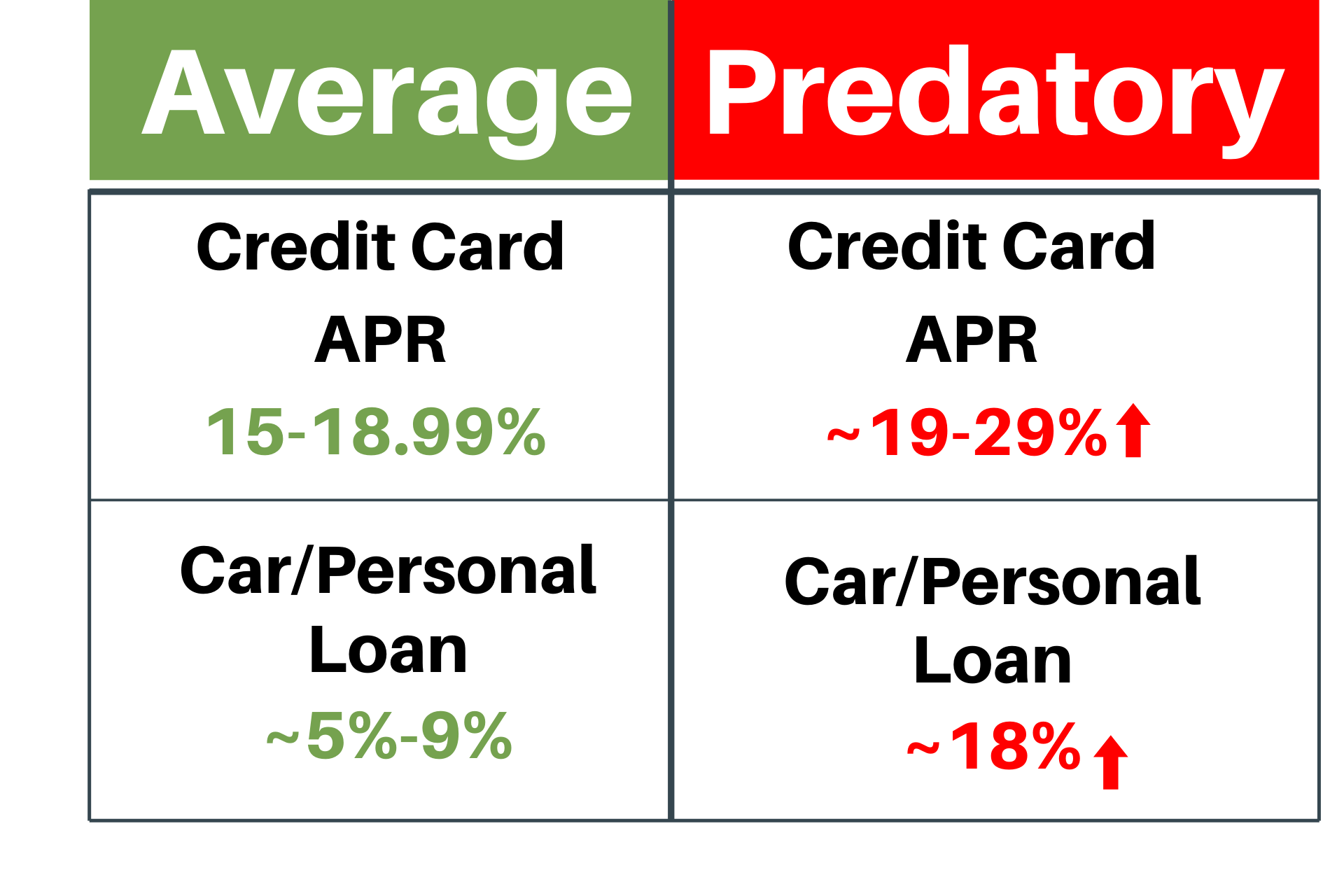

Predatory loans or credit cards have excessive interest rates, or interest rates that are much higher than the average. Typical Annual Percentage Rates (APRs) for a credit card can be around 15-18%, whereas predatory credit cards have APRs from 20-29%. A predatory rate for personal or car loans is generally over 18%. These interest rates result in unaffordable payments, excessively long loan terms, and/or debt that seems impossible to get out from under. They are designed this way; for corporations to make money off of lending money.

Predatory lending includes payday and auto title loans. Our Executive Director fought tirelessly with the Ohioans for Payday Loan Reform Coalition to place a percentage cap on payday lending interest rates to stop this cycle of preying on financially insecure individuals. Despite these recent sanctions, Ohioans are still at risk of predatory loan rates. We often see people get into trouble by taking out loans through online lenders that originate outside of Ohio where these sanctions do not apply. Some of these loans bear interest in the triple digits! We have seen interest rates well over 500% from these online loans. HFLA’s program staff helped a woman get out of a loan with a 638% APR just last week.

Before you take out a high interest rate loan, read this article.

Every week, we speak to people who are burdened by high interest predatory loans. We realize that often the only choice that many people have when it comes to getting the financing that they need. For many people, this could be the first time they have ever been able to get financed due to poor credit history, or no credit history.

In their excitement to solve their pressing financial issue, the high interest rate or bi-weekly payment schedule is overlooked. Predatory lending preys on desperate situations and bad timing. They are financing options disguised and advertised as “good opportunities” to those who have bad credit and even promote “credit building” as a part of the lure. The reality is that they often force people to borrow more than they need, and the repayment can lead to a downward spiral of debt that is almost impossible to get back out of.

Individuals seeking personal loans are not the only ones at risk of predatory lenders. Small business owners have become a new target for high-interest lending. Business loans are typically very hard to get, especially for startup companies. Predatory interest rates–typically found from online lenders–can be up to 49% APR.

Our call to action: Always be wary of any financing option you apply for.

1. If someone solicits you for a loan or credit card — RED FLAG — this is likely predatory.

-

-

Someone is trying to seek you out to give you money? Sounds too good to be true! Probably because they are going to make money off of you.

-

2. Read through the terms and conditions of the loan or credit card you are applying for.

-

-

Look for the Truth in Lending Act (TILA) in the document. This page will list the amount financed, the finance charge, the Annual Percentage Rate, and what the total amount of the payments will be at the end of the loan.

-

3. If you are currently having trouble managing your debt or have high interest rates on your loan or credit cards: Seek out help from a free financial counselor or coach today!

Here are some of the financial counseling services offered by nonprofits in the Northeast Ohio Region that we recommend:

- Cleveland Neighborhood Progress – communityfinancialcenters.org

- ESOP at Benjamin Rose Institute on Aging (for seniors and housing) – esop-cleveland.org

- United Way’s Financial Empowerment Center (FEC) – uwsummit.org/FEC

- CHN Housing Partners – chnhousingpartners.org

Resources for small business owners:

- ECDI (throughout Ohio) & the Women’s Business Center – ECDI.org

- Ohio Small Business Development Centers (SBDCs) – clients.ohiosbdc.ohio.gov

- SCORE – score.org

About HFLA of Northeast Ohio

HFLA of Northeast Ohio was founded in 1904 with $501 donated by Charles Ettinger, Morris Black, and their friends to help European refugees settle and begin productive lives in this country. They believed – as we do now – that if you give someone a chance to succeed, they will pay it back and we can continue this transformative cycle. The same principle guides the organization today. By providing interest-free loans to individuals, families, and small businesses in the Northeast Ohio area, we are able to help people help themselves. The association has drastically increased its lending capital in the past few years from individual gifts, bequests, endowments, foundation grants, memorials and honorariums and is now operating with a loan fund of over $1 million. HFLA is a 501(c)3 non-profit organization. Learn more about HFLA.

Get involved and stay up to date by subscribing to our quarterly newsletter or following us on social media.

2019 Year in Review

2019 was a record year for HFLA of Northeast Ohio.

We have seen a remarkable jump in loans disbursed, are moving more Northeast Ohioans toward financial stability, and are now able to plan steady and deliberate growth into the future.

This exemplary year would have never been possible without the dedication and advocacy of our supporters. With the continued commitment of our donors, board members, loan recipients, and staff we can maintain this growth that has built upon itself for the last 115 years and perpetuate HFLA’s ability to strengthen individuals and families into the future.

For the first time in over two decades we disbursed 100 loans in the year, surpassing 2018’s loan disbursements by 23 loans. This significant jump clearly shows the impact of our dollars at work. These interest free loans directly impacted 266 individuals within Northeast Ohio and countless others when considering the economic impact of the small business loan recipients.

We continued our efforts to financially empower our loan recipients, and are happy to announce that 100% of 2019’s loan recipients are having their loans reported to the three major credit bureaus. This is moving them closer to their financial goals and increasing their financial stability. Building and maintaining positive credit is a major stepping stone towards financial freedom for many of our borrowers. In making timely payments on our loans, our borrowers are heading toward becoming capable of receiving traditional financing for mortgages and personal loans in the future.

With the growth that HFLA has experienced, and the clear demand for affordable capital in the region, we know that we need to create clear and concrete steps towards the future. This year, HFLA of Northeast Ohio will be creating a new strategic plan to chart the next 3-5 years. In creating this plan we will keep our stakeholders at the forefront of our conversations and will continue to rely on our core supporters and community advocates.

We will engage these voices to establish strategies that ensure stable growth and increases our ability to empower our shared community towards financial freedom and self-sufficiency.

Get involved and stay up to date by subscribing to our quarterly newsletter or following us on social media.

About HFLA of Northeast Ohio

HFLA of Northeast Ohio was founded in 1904 with $501 donated by Charles Ettinger, Morris Black, and their friends to help European refugees settle and begin productive lives in this country. They believed – as we do now – that if you give someone a chance to succeed, they will pay it back and we can continue this transformative cycle. The same principle guides the organization today. By providing interest-free loans to individuals, families, and small businesses in the Northeast Ohio area, we are able to help people help themselves. The association has drastically increased its lending capital in the past few years from individual gifts, bequests, endowments, foundation grants, memorials and honorariums and is now operating with a loan fund of over $1 million. HFLA is a 501(c)3 non-profit organization. Learn more about HFLA.

JumpStart Grants HFLA of Northeast Ohio $150,000 for Interest-Free Loans

JumpStart Grants HFLA of Northeast Ohio $150,000 for Interest-Free Loans

Latinx and African American Entrepreneurs and Small Businesses

HFLA of Northeast Ohio received a generous grant from JumpStart allowing expansion of their small business lending activity in the region. With this support, HFLA will expand the number of interest-free loans of up to $10,000 available to minority-owned small businesses needing capital but lacking access to traditional lending sources.

“We are thrilled JumpStart understands the pressing need small business owners have for alternative lending in the form of interest-free loans. This grant gives HFLA the opportunity to increase lending capacity and reach more entrepreneurs who need access to affordable capital,” shared Michal Marcus HFLA Executive Director.

“JumpStart’s mission is to unlock the full potential of diverse and ambitious entrepreneurs to grow their businesses, create jobs and economically transform our community,” JumpStart’s CEO Ray Leach shared. “HFLA is a trusted community organization with an impressive history of interest-free lending. We are excited to support their efforts in lending more capital to Latinx and African American entrepreneurs and small business owners in the city of Cleveland.”

HFLA has been lending interest-free in Northeast Ohio since 1904. The past three years we have seen a significant increase in small business lending to minority owned businesses.

Additional information can be found at https://interestfree.org/.

About HFLA of Northeast Ohio

HFLA of Northeast Ohio was founded in 1904 with $501 donated by Charles Ettinger, Morris Black, and their friends to help European refugees settle and begin productive lives in this country. They believed – as we do now – that if you give someone a chance to succeed, they will pay it back and we can continue this transformative cycle. The same principle guides the organization today. By providing interest-free loans to individuals, families, and small businesses in the Northeast Ohio area, we are able to help people help themselves. The association has drastically increased its lending capital in the past few years from individual gifts, bequests, endowments, foundation grants, memorials and honorariums and is now operating with a loan fund of over $1 million. HFLA is a 501(c)3 non-profit organization. Learn more about HFLA.

HFLA Corporate Partner Program

Investing in Northeast Ohio’s renewal starts with investing in its most precious resource, its residents.

HFLA has specialized in providing long-term financial relief solutions to the residents of this great region for 115 years. 2020 plans include scaling up operations and empowering even more Northeast Ohio residents with interest-free loans. Partnering with HFLA to achieve these goals provides your organization with the ability to directly impact individual residents and help build sustainable change.

The HFLA Corporate Partner Program gives your organization the ability to create a loan pool fund that will expand your reach into Northeast Ohio communities, specifically, those with high concentrations of low to moderate income residents.

To learn more about HFLA's Corporate Partner Program and how to become a partner, please click here here.

Michal Marcus honored as one of CJN's 18 Difference Makers

Last night, Cleveland Jewish News hosted the fifth annual 18 Difference Makers Awards Ceremony. HFLA of Northeast Ohio’s Executive Director, Michal Marcus, was honored as a Difference Maker for positively impacting the lives of Northeastern Ohioans for over thirteen years. Michal has been the Executive Director for the past six years, and the organization has grown tremendously under her leadership. HFLA had just under $300,000 in microloans on the street when Michal began leading the organization and now has over $1,000,000 in the hands of students, small business owners, and people in need of a hand up throughout our community. Michal believes that interest-free lending can make very big difference in the lives of people experiencing financial difficulties, and is proud of the fact that HFLA applies the Jewish principle of lending money interest-free to those in need to all of Northeast Ohio, regardless of religious affiliation. Mazel tov, Michal!

To read CJN’s article about Michal, click here.

City of Cleveland Awards HFLA $75,000

FOR IMMEDIATE RELEASE

Michal Marcus (HFLA)

Tel: 216-378-9042

Email: michal@interestfree.org

City of Cleveland Awards HFLA $75,000 for a Start-up Working Capital Fund Pilot Program

Cleveland, Ohio (SEPTEMBER 19, 2019) – Cleveland City Council approved $75,000 in funding to partner with the nonprofit Hebrew Free Loan Association (HFLA) for the creation of a joint pilot program, Start-up Working Capital. Working in conjunction with the City of Cleveland’s Neighborhood Retail Assistance Program, this citywide initiative will provide working capital for locally-owned retail establishments, alleviating cash flow issues associated with start-up businesses.

The program will enable HFLA to provide up to $5,000 in the form of interest-free loans for eligible small businesses located or soon to open in the City of Cleveland.

“We are thrilled that the City of Cleveland understands the impact of interest-free loans for small business entrepreneurs. This grant from the City of Cleveland Economic Development department will truly allow us to expand upon our partnership and the number of small businesses we can help with an interest-free loan and we look forward to our continued work together,” says Michal Marcus, Executive Director of HFLA.

can help with an interest-free loan and we look forward to our continued work together,” says Michal Marcus, Executive Director of HFLA.

Kevin Schmotzer, Executive of Small Business Development with the City of Cleveland’s Department of Economic Development says, “this builds upon a partnership between the City of Cleveland and HFLA that will provide additional capital to our entrepreneurs and small businesses to grow in our respective neighborhoods.”

About HFLA of Northeast Ohio

HFLA of Northeast Ohio was founded in 1904 with $501 donated by Charles Ettinger, Morris Black, and their friends to help European refugees settle and begin productive lives in this

country. They believed – as we do now – that if you give someone a chance to succeed, they will pay it back and we can continue this transformative cycle. The same principle guides the

organization today. By providing interest-free loans to individuals, families, and small businesses in the Northeast Ohio area, we are able to help people help themselves. The association has drastically increased its lending capital in the past few years from individual gifts, bequests, endowments, foundation grants, memorials and honorariums and is now operating with a loan fund of over $1 million. HFLA is a 501(c)3 non-profit organization. Learn more about HFLA.

###

Loan Spotlight: Mary Johnson, owner of Vitiman Kandie

Vitiman Kandie, LLC is the brainchild of Clevelander, Mary Johnson. She is a personal trainer and healthy lifestyle guru.

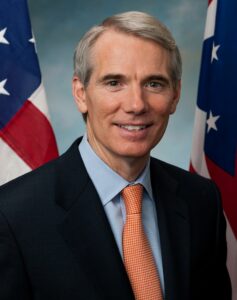

HFLA of NEO's Letter to Senator Portman

HFLA of NEO Board president, Lisa Arlyn Lowe recently sent the following letter to Ohio Senator Rob Portman in support of his opposition to the health care bill currently before the Ohio Senate.

HFLA of NEO Board president, Lisa Arlyn Lowe recently sent the following letter to Ohio Senator Rob Portman in support of his opposition to the health care bill currently before the Ohio Senate.

Dear Senator Portman:

Thank you for opposing the health care bill that is currently before the Senate. In its present form, the Senate Bill is detrimental to all Americans—not just your Ohio constituents. In addition to slashing Medicaid and Medicare, as well as denying millions of Americans access to affordable health care, it limits (or prevents) access to care for opioid addiction - an issue about which I know you are personally passionate.