JumpStart Grants HFLA of Northeast Ohio $150,000 for Interest-Free Loans

JumpStart Grants HFLA of Northeast Ohio $150,000 for Interest-Free Loans

Latinx and African American Entrepreneurs and Small Businesses

HFLA of Northeast Ohio received a generous grant from JumpStart allowing expansion of their small business lending activity in the region. With this support, HFLA will expand the number of interest-free loans of up to $10,000 available to minority-owned small businesses needing capital but lacking access to traditional lending sources.

“We are thrilled JumpStart understands the pressing need small business owners have for alternative lending in the form of interest-free loans. This grant gives HFLA the opportunity to increase lending capacity and reach more entrepreneurs who need access to affordable capital,” shared Michal Marcus HFLA Executive Director.

“JumpStart’s mission is to unlock the full potential of diverse and ambitious entrepreneurs to grow their businesses, create jobs and economically transform our community,” JumpStart’s CEO Ray Leach shared. “HFLA is a trusted community organization with an impressive history of interest-free lending. We are excited to support their efforts in lending more capital to Latinx and African American entrepreneurs and small business owners in the city of Cleveland.”

HFLA has been lending interest-free in Northeast Ohio since 1904. The past three years we have seen a significant increase in small business lending to minority owned businesses.

Additional information can be found at https://interestfree.org/.

About HFLA of Northeast Ohio

HFLA of Northeast Ohio was founded in 1904 with $501 donated by Charles Ettinger, Morris Black, and their friends to help European refugees settle and begin productive lives in this country. They believed – as we do now – that if you give someone a chance to succeed, they will pay it back and we can continue this transformative cycle. The same principle guides the organization today. By providing interest-free loans to individuals, families, and small businesses in the Northeast Ohio area, we are able to help people help themselves. The association has drastically increased its lending capital in the past few years from individual gifts, bequests, endowments, foundation grants, memorials and honorariums and is now operating with a loan fund of over $1 million. HFLA is a 501(c)3 non-profit organization. Learn more about HFLA.

HFLA Corporate Partner Program

Investing in Northeast Ohio’s renewal starts with investing in its most precious resource, its residents.

HFLA has specialized in providing long-term financial relief solutions to the residents of this great region for 115 years. 2020 plans include scaling up operations and empowering even more Northeast Ohio residents with interest-free loans. Partnering with HFLA to achieve these goals provides your organization with the ability to directly impact individual residents and help build sustainable change.

The HFLA Corporate Partner Program gives your organization the ability to create a loan pool fund that will expand your reach into Northeast Ohio communities, specifically, those with high concentrations of low to moderate income residents.

To learn more about HFLA's Corporate Partner Program and how to become a partner, please click here here.

Loan Spotlight: Mary Johnson, owner of Vitiman Kandie

Vitiman Kandie, LLC is the brainchild of Clevelander, Mary Johnson. She is a personal trainer and healthy lifestyle guru.

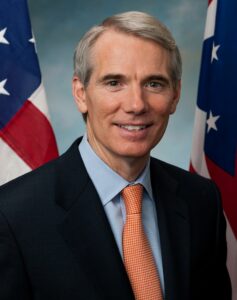

HFLA of NEO's Letter to Senator Portman

HFLA of NEO Board president, Lisa Arlyn Lowe recently sent the following letter to Ohio Senator Rob Portman in support of his opposition to the health care bill currently before the Ohio Senate.

HFLA of NEO Board president, Lisa Arlyn Lowe recently sent the following letter to Ohio Senator Rob Portman in support of his opposition to the health care bill currently before the Ohio Senate.

Dear Senator Portman:

Thank you for opposing the health care bill that is currently before the Senate. In its present form, the Senate Bill is detrimental to all Americans—not just your Ohio constituents. In addition to slashing Medicaid and Medicare, as well as denying millions of Americans access to affordable health care, it limits (or prevents) access to care for opioid addiction - an issue about which I know you are personally passionate.

HFLA's Fight Against Payday Loans

One of HFLA of Northeast Ohio’s goals is to fight unfair payday loans in the state of Ohio. We are extremely passionate about this mission as we often work with clients who have fallen into the vicious cycle of payday loan debt.

On March 20, 2017, our Executive Director Michal Marcus appeared on NPR to discuss payday loan legislation reform and talk about HFLA’s work with payday loans.

The following is adapted from that conversation. To hear the discussion for yourself, click here.

Information on Payday Loan Reform Legislation

The Ohioans for Payday Loan Reform Coalition reached out to HFLA after Michal's interview on NPR, and provided us with the following information for anyone who may be interested in House Bill 123 and the current reform efforts:

Dear Supporters of Payday Loan Reforms:

The payday lending reform bill, Ohio House Bill 123, has been assigned to the House Government Accountability & Oversight Committee, chaired by Rep. Louis “Bill’’ Blessing III, R-District 29, who represents part of Hamilton County.

We are asking you to reach out to committee members from Cuyahoga County, the chairman of the committee and committee members who have announced they are going to run for statewide office in upcoming elections. Please tell the committee members that you support reform and why. If they are running for statewide office, please mention that in your communication.

Also, if you live in one of these legislators’ districts, would you please let us know? If you do, we can let you know when they are holding in-district public meetings which you might be able to attend to bring up payday lending reform.

Cuyahoga County committee members:

Rep. Dave Greenspan, District 16; western Cuyahoga County, including Westlake, Bay Village, Rocky River, Fairview Park, North Olmsted

- Email here: http://www.ohiohouse.gov/dave-

greenspan/contact - Call 614.466.0961

Committee Chair

Chairman Rep. Louis “Bill’’ Blessing III, District 29; Hamilton County/Southwest Ohio

- Email here: http://www.ohiohouse.gov/

louis-blessing/contact - Call 614.466.9091

Other committee members:

Vice Chair Rep. Bill Reineke, District 88; Sandusky and Seneca counties

- Email here: http://www.ohiohouse.gov/bill-

reineke/contact - Call 614.466.1374

Rep. Timothy E. Ginter, District 5; Columbiana County

- Email here: http://www.ohiohouse.gov/

timothy-e-ginter/contact - Call 614.466.8022

Rep. Bernadine Kennedy Kent, District 25; part of Franklin County, including Whitehall, Gahanna, Bexley and part of Columbus

- Email here: http://www.ohiohouse.gov/

bernadine-kennedy-kent/contact - Call 614.466.5343

Rep. Ryan Smith, District 93; Lawrence, Gallia, Jackson and part of Vinton counties

- Email here: http://www.ohiohouse.gov/ryan-

smith/contact - Call 614.466.1366

Rep. Bill Seitz, District 30; parts of Hamilton County

- Email here: http://www.ohiohouse.gov/bill-

seitz/contact - Call 614.466.8258

Key news media coverage of reform efforts

- March 27, Columbus Dispatch, Editorial, It’s time to rein in payday lenders, http://www.dispatch.com/

opinion/20170327/editorial- its-time-to-rein-in-payday- lenders - March 24, Canton Repository, Editorial, State lawmakers consider new rules for payday lenders,

- http://www.cantonrep.com/

opinion/20170323/editorial- state-lawmakers-consider-new- rules-for-payday-lenders/1 - March 20, WCPN Cleveland, Sound of Ideas show, payday lending panel including Rep. Koehler, http://www.ideastream.org/

programs/sound-of-ideas/ payday-lending-0 - March 19, Columbus Dispatch, As Ohio payday lending law fails, some lawmakers ready for new regulations, http://www.dispatch.com/news/

20170319/as-ohio-payday- lending-law-fails-some- lawmakers-ready-for-new- regulations - March 19, Crain’s Cleveland Business, Get it right, http://www.crainscleveland.

com/article/20170319/VOICES01/ 170319824/crains-editorial- get-it-right?X- IgnoreUserAgent=1 - March 17, Statehouse News Bureau, Another crackdown on payday lenders back to lawmakers, but industry is ready to right back, http://statenews.org/post/

another-crackdown-payday- lenders-back-lawmakers- industry-ready-push-back

Michal Marcus on NPR

Yesterday, our Executive Director Michal Marcus was on NPR's Sound of Ideas to discuss payday lending. She was on a panel with State Representative Kyle Koehler and Keith Davis, a Financial Capabilities Counselor with Neighborhood Housing Services of Greater Cleveland. They discussed payday lending and its implications on borrowers, as well as a new bill proposed to close a loophole in current legislation that allows payday lenders to get around 2008's legislation, which capped interest rates at 28%. Through this loophole, payday lenders have continued to lend with interest rates sometimes reaching as high at 700% APR. Listen to the podcast here to learn more!

Build, Improve, or Monitor Your Credit for FREE with NerdWallet!

Exciting news: HFLA partnered with NerdWallet to bring their credit tracking tools to our borrowers, applicants, and friends. This is an online platform that allows you to create an account and view your credit report whenever you choose!

NerdWallet's credit tracking platform allows you to set goals pertaining to your credit (ex: increase my score), and will then give you tips on how to reach that goal. It also shows you how much your credit score would be affected by different decisions regarding your personal credit (opening a new credit card, paying off a balance in full, etc...) so that you know exactly how your credit score will be impacted.

you to set goals pertaining to your credit (ex: increase my score), and will then give you tips on how to reach that goal. It also shows you how much your credit score would be affected by different decisions regarding your personal credit (opening a new credit card, paying off a balance in full, etc...) so that you know exactly how your credit score will be impacted.

You can create an account with NerdWallet through this link: https://www.nerdwallet.com/blog/hflaclev/