Celebrating Centrovilla

Located on Cleveland’s near west side, the Clark-Fulton neighborhood is one of the city’s most densely populated and ethnically diverse communities, including the highest concentration of Hispanics in the city.

The Northeast Ohio Hispanic Center for Economic Development (NEOHCED) is the umbrella organization for the Northeast Ohio Hispanic Chamber of Commerce, the Hispanic Business Center, and Hispanic Community Development. NEOHCED is the lead organization for the redevelopment and placemaking initiative–La Villa Hispana.

For ten years, this coalition of organizations has been working to achieve their vision of a community “hub” that celebrates the rich Latino heritage in the Clark-Fulton neighborhood, while fostering substantial economic growth. These grand visions have become a reality with the completion of CentroVilla25! The building, with over 32,000 square feet of space, is home to 20 microenterprises, including a food hall representing several Latin cultures and retail options. Jenice Contreras, the President and CEO of NEOHCED, excitedly shares, “You’ll smell it, taste it, feel it, experience everything that is CentroVilla 25 and what the vendors and the community bring.”

Investing in these spaces will draw people into the neighborhood and breathe new life into the soul of the community. The most valuable aspect of this project is supporting individuals already part of this community. HFLA is proud to have provided business loans to seven businesses settling into their new spaces in CentroVilla25. Five are food businesses, each boasting its own unique flavor, culture, and history. We are thrilled to witness the excitement on our borrowers’ faces as their dreams become a reality.

Here is a listing of all the small business owners operating at CV25:

Realtor Joel Rodriguez Velez – Real estate services

Antojitos Salvadoreños y Más – Authentic Salvadoran food

Mine’Angel Collections – Handcrafted jewelry

Tumbao58 – Venezuelan eats with bold flavor

Flying Pig Tacos – Mexican street-style tacos

Sazón Latino – Classic Cuban dishes

Panitos – Salvadoran pastries & breads

Café Roig – Puerto Rican coffee & sweets

JirehBoutique – Trendy clothing & accessories

Alnairis’s Custom Design – Custom tumblers & gifts

Lebeni.Esthetic LLC – Facials & body care

Vintage & Vaina – Collectibles, games & toys with retro flair!

Marie Narvarro is quick to tell you how excited she is to see her business, Tumbao55, take off. Coming to the US in 2020, she decided to take her passion for cooking to the next level.

She has loved interacting with the community at large, finding that she had no choice but to learn about the foods, behaviors, and general cultures of the new space she was inhabiting. As much as she is loyal to Venezuela, her home country, interacting with the various Latino communities here in Cleveland has allowed her to appreciate the vast diversity of foods available, broadening her mind and palate. “Every country has its secret, its flavors. It’s not competition, it’s like ‘Oh, I want to share’.” Tumbao is her chance to give a little slice of home to every customer who comes in.

“HFLA was the light at the end of the tunnel,” Marie said with a smile. She had saved up enough money to feel like she had the foundation for her business, and noted that luckily, HFLA believed in her and became the final step in making her dream come true. “Everything is very exciting.”

She’s grateful for organizations like HBC and Jumpstart for giving the Latino community resources to get ahead. “We are raising our voices, and they’re seeing we have the strength to be a part of this community too and help develop this country in the best way possible.”

Watch Marie’s full interview with HFLA’s Development Associate Alexis Paredes here.

The grand opening for CentroVilla is May 31st! Find tickets for all their events here!

Ribbon Cutting Ceremony: May 30th, 10 AM

Inaugural Gala: May 30th, 6 PM

Sabor y Ritmo Festival: May 31st, 1 PM

CentroVilla Hours:

Monday: Closed

Tuesday – Saturday: 8 AM – 8 PM

Sunday: 10 AM – 6 PM

An Attack on Education

“Education is our most important national investment.” - President Jimmy Carter

In October 1979, under Jimmy Carter's presidency, the Department of Education was created with the mission of strengthening “the Federal commitment to ensuring access to equal educational opportunity for every individual” and supporting “more effectively States, localities and public and private institutions in carrying out their responsibilities for education.” Operations officially began in May 1980.

On March 20th, 2025, current President Donald Trump signed the Improving Education Outcomes by Empowering Parents, States, and Communities Executive Order, imploring the closing of the Department of Education. President Trump believes that the current way the department is being managed makes it ill-equipped to handle the student loan debt portfolio and overtly prioritizes “illegal discrimination” via diversity, equity, and inclusion initiatives.

Accessibility to higher education is under threat, with diversity-based scholarships on the chopping block. In a letter from the Department of Education’s Office for Civil Rights, Acting Assistant Secretary Craig Trainor wrote that race cannot be factored into various decisions, including financial aid and scholarships.

Race blind scholarships and grants aren’t safe either. The Pell Grant program, which is received by 34% of undergraduate students, distributes aid to students who show financial need to support their education. The program is currently expected to run out of reserves by the end of 2025, hitting a $71-111 billion shortfall over the next 10 years. Federal funding could be used to fill this deficit, but in February 2025, the US House of Representatives passed a budget resolution to cut $330 billion for education and workforce spending over the next decade, voting against giving education the resources needed to make the system prosperous.

Though we cannot rectify all current situations, we can still strive to support education wherever possible. HFLA’s education loans are need-based financial opportunities that students can utilize to achieve their academic goals. We also cover experiences that extend beyond the typical four-year undergraduate programs. Education should feel like an attainable goal for dedicated students, rather than an insurmountable challenge. HFLA is here to assist anyone wishing to pursue a new lifestyle, and finances should not become a barrier.

If you believe that limiting education and efforts to eliminate the Department of Education should not be pushed, call your representatives to voice your opposition to striking down the Department of Education:

If you are in Ohio, here are the numbers to call:

Senator Bernie Moreno: 202-224-2315

Senator John Husted: 202-224-3353

Representative Shontel Brown (Northeast Ohio): 202-225-7032

Script:

Hi, my name is [NAME] and I’m a constituent from [CITY, ZIP].

I’m calling to demand that [REP/SEN NAME] strongly oppose H.R. 899 and Trump's executive order to dismantle the Department of Education. It is crucial that Congress stand firm against this blatant executive overreach and protect the Department's vital programs and protections for students.

Thank you for your time and consideration.

IF LEAVING VOICEMAIL: Please leave your full street address to ensure your call is tallied.

(Script provided by the 5 Calls app)

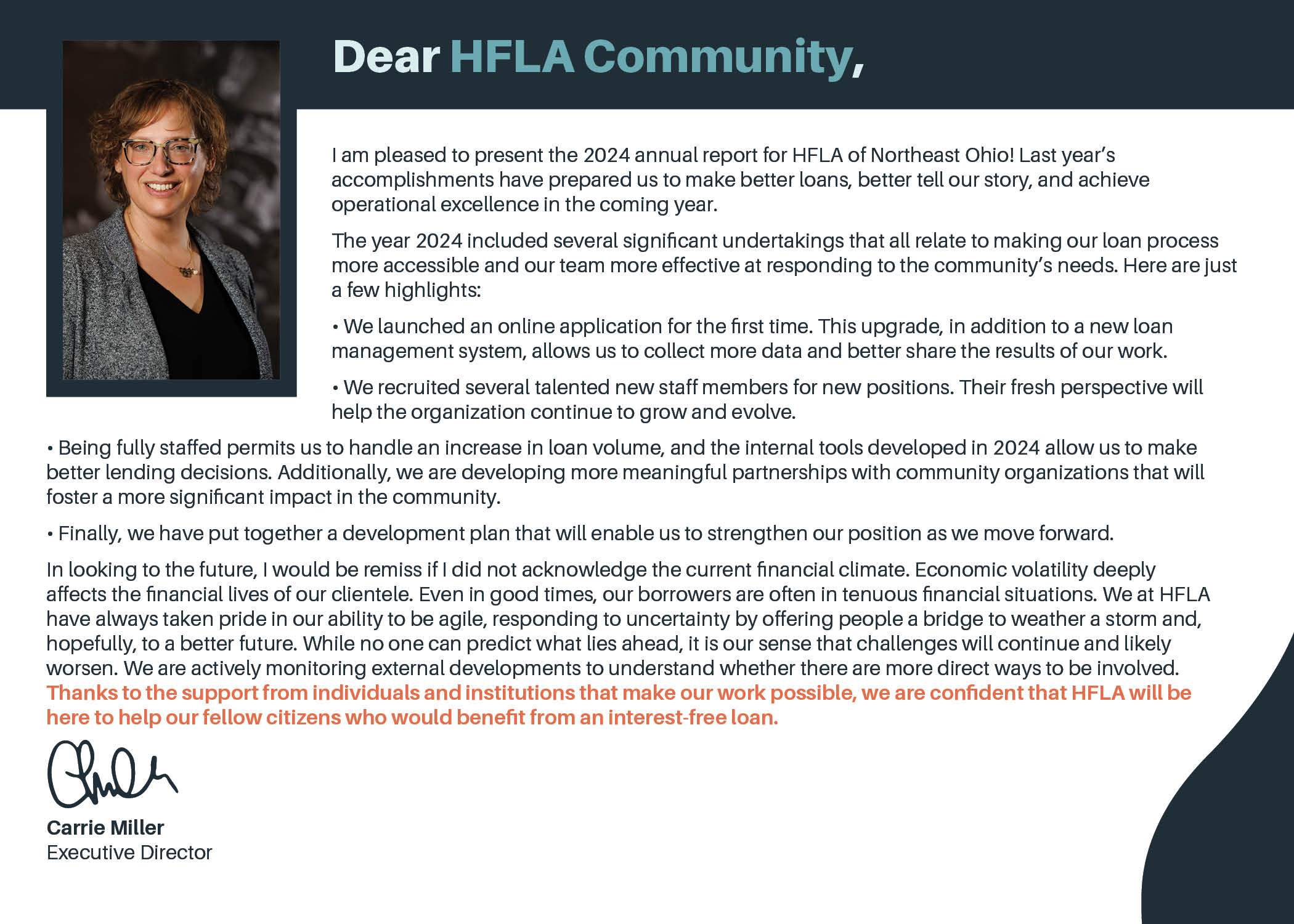

2024 Annual Report

We are pleased to share our 2024 annual report!

The organization saw a lot of activity in 2024 – a new location, new staff members, and a new attitude! Last year saw a lot of change, which prepared us for a strong start to 2025. In the first quarter of 2025, we made 14 loans totaling $83,405! Our primary goal in increasing our staff capacity is to build upon and improve our application experience and what support we can offer during and after loan repayment. We can’t wait to share what we’ve got in store for this year.

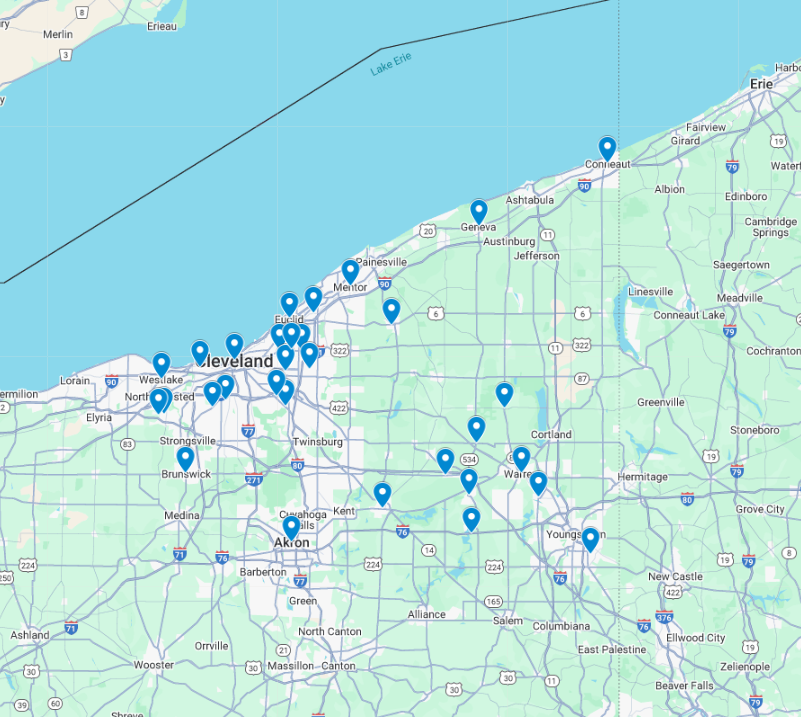

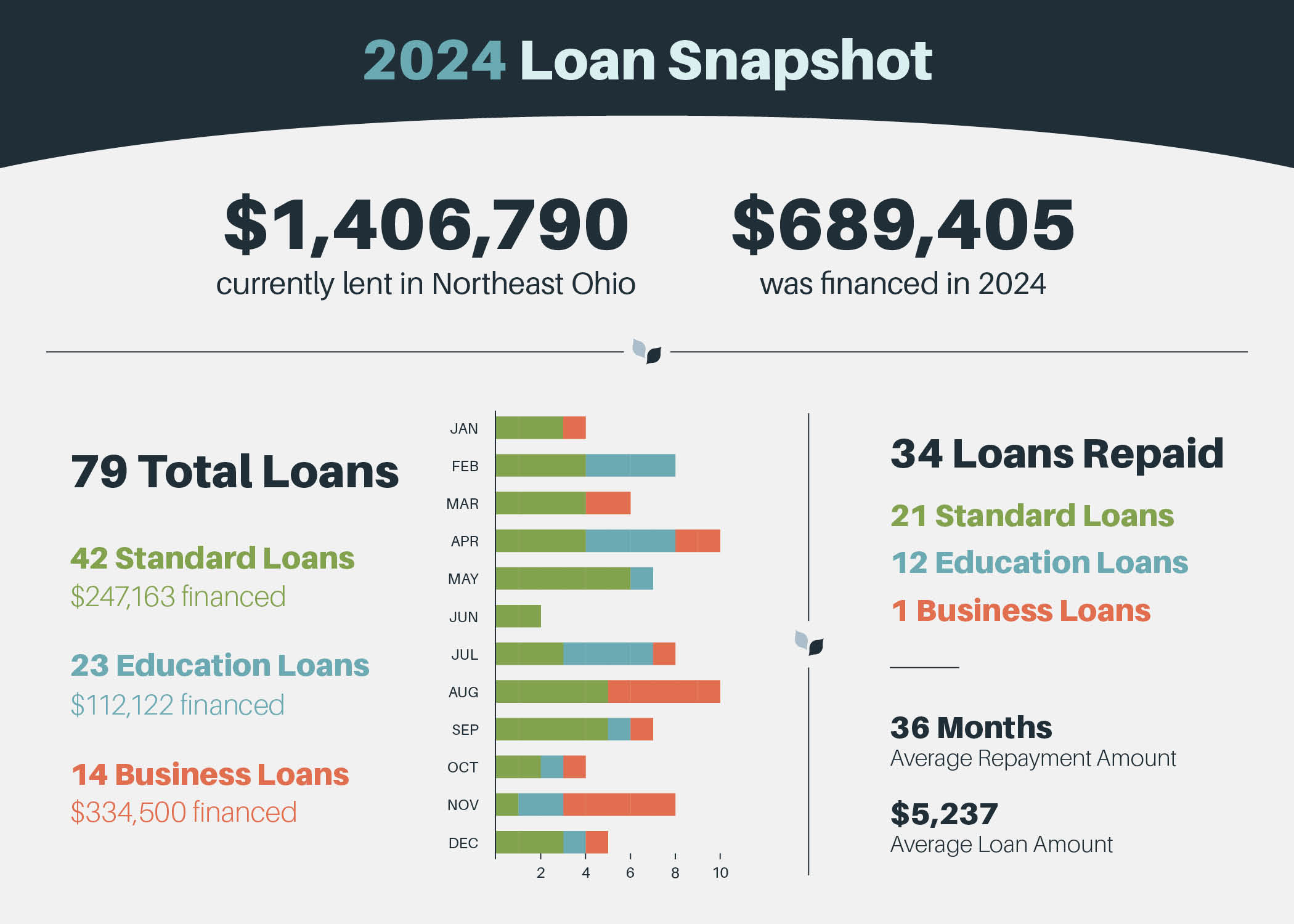

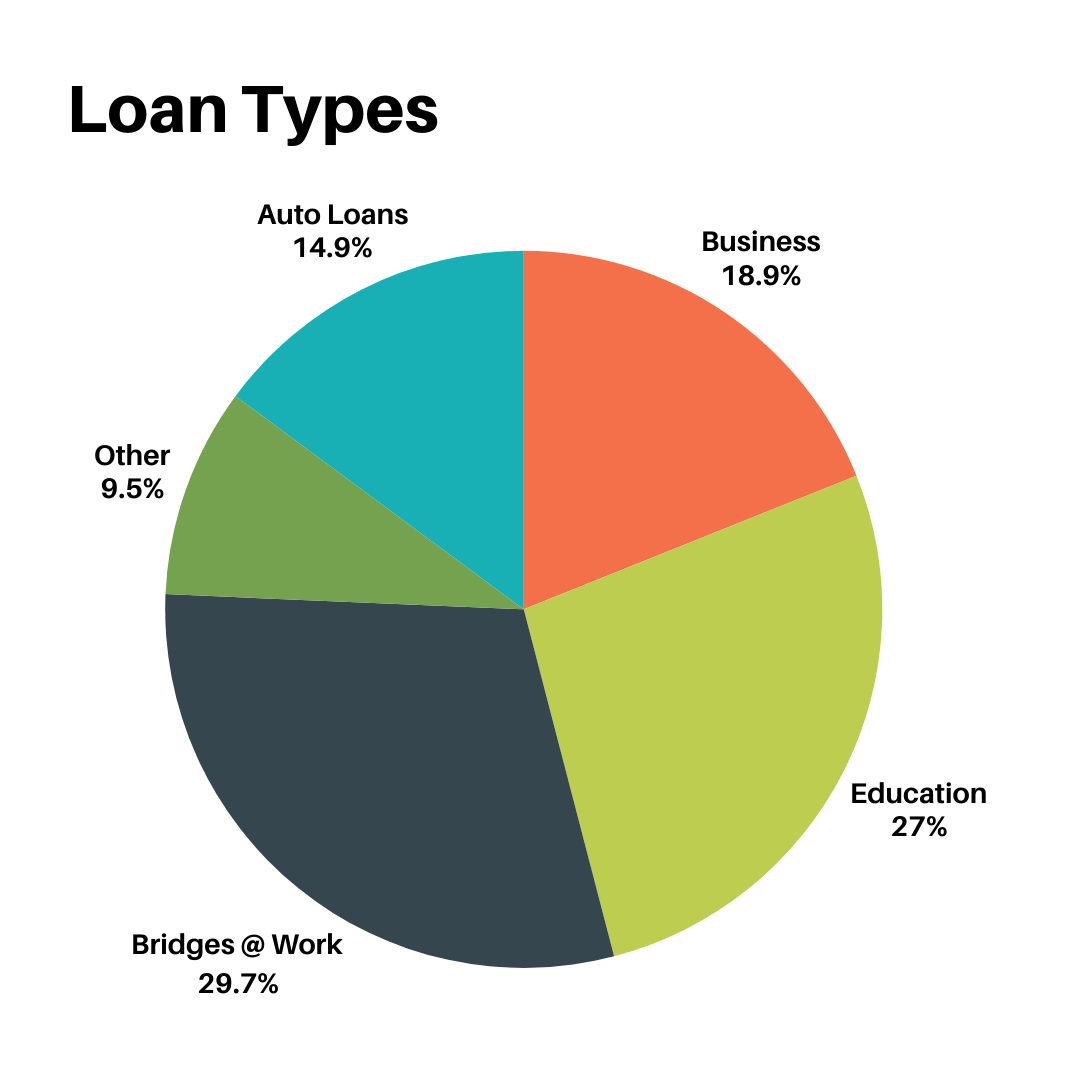

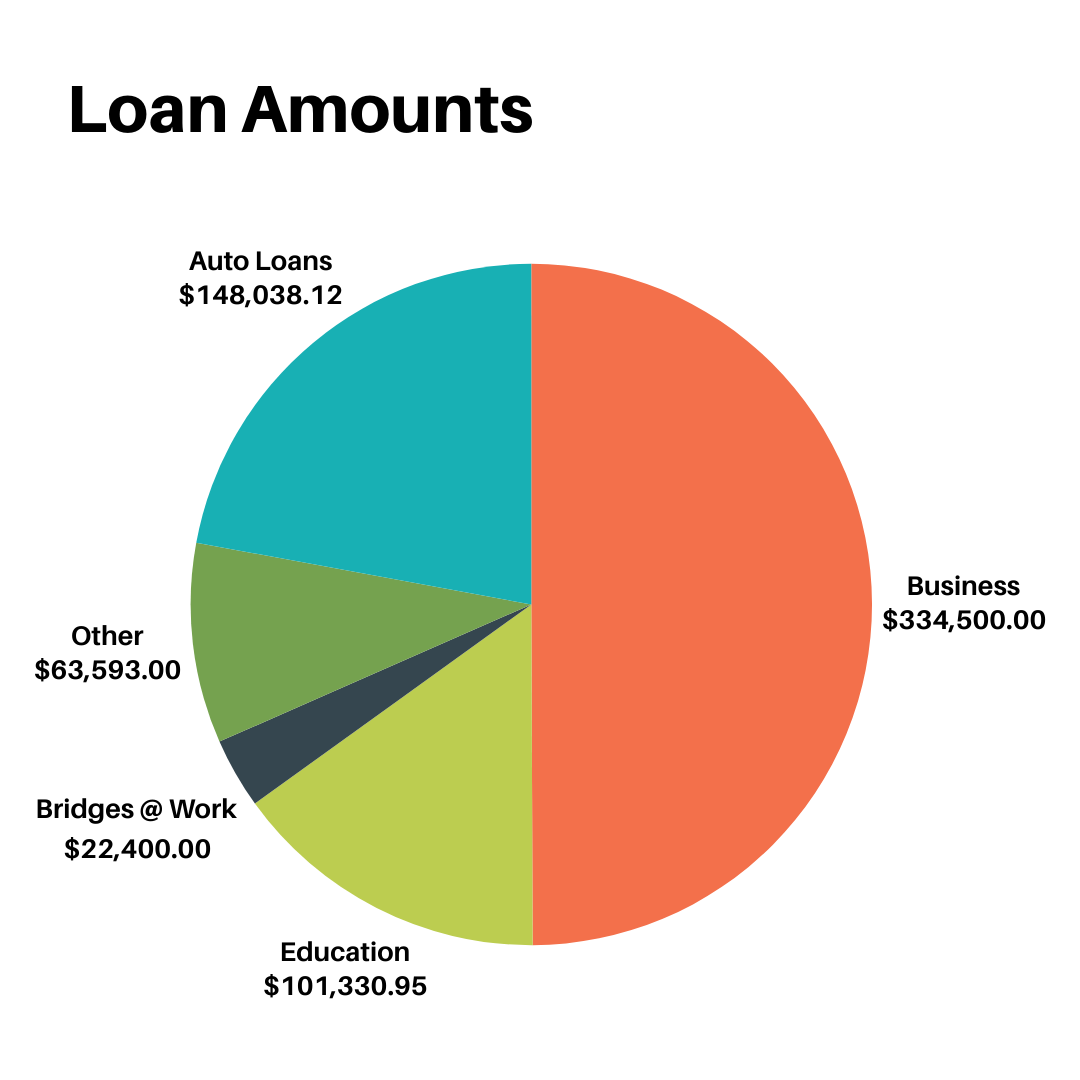

In 2024, we continued to serve the Northeast Ohio region, covering 31 cities. We made 79 loans totaling $689,405 to the community. We are so incredibly grateful to have worked with our borrowers to get them one step closer to financial wellness. There has also been incredible growth in our business lending. We anticipate that it will continue to grow in 2025!

Five of our 14 business loans were given to new business owners opening up in CentroVilla25. These loans were to help them settle into their new homes and get their kiosks up and running so they could attract new clientele in a new space. The building is already buzzing with activity and we are proud to be a small part of building such a vibrant location.

Ten of our Standard Loans this year were auto loans. While we have indefinitely paused auto lending, we are happy to have assisted so many individuals in securing transportation. To learn more about our decision to pause auto loans, read our February blog post, “To Loan or Not to Loan?… The Future of HFLA Auto Loans.”

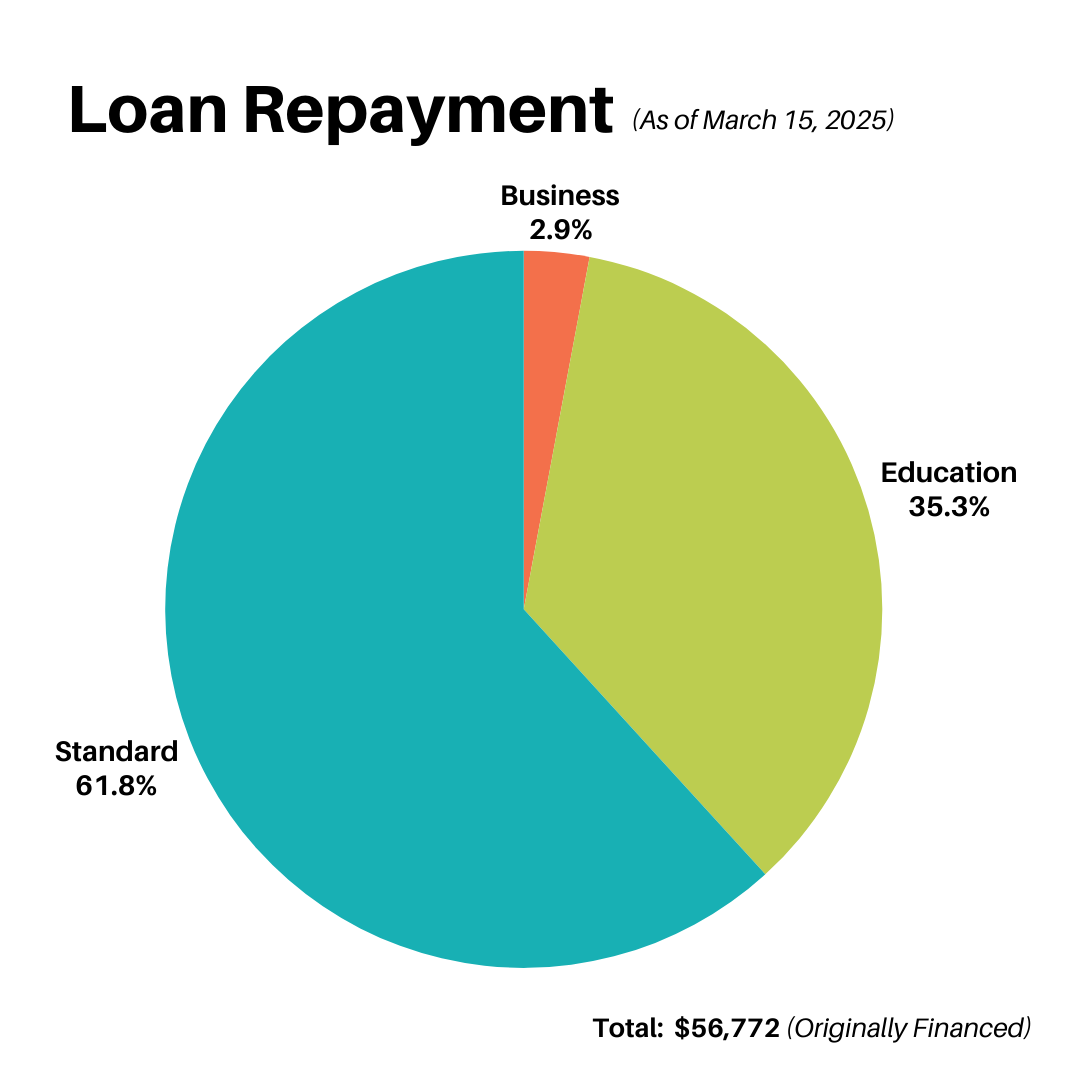

As of March 15, 2025, we have 239 active loans with $1,406,790 in the community! In the first quarter of 2025, thirty-four borrowers made their last payment to HFLA, having paid their loans in full!

We are beyond proud of all of our borrowers who have been able to finish paying their loans and are living in a different reality than when they first applied to us! The average repayment rate was 36 months, with the average loan amount being $5,237. Being one step closer to financial success is always something to celebrate. Once again, congratulations to our amazing borrowers, and we can’t wait to see what the future holds for them.

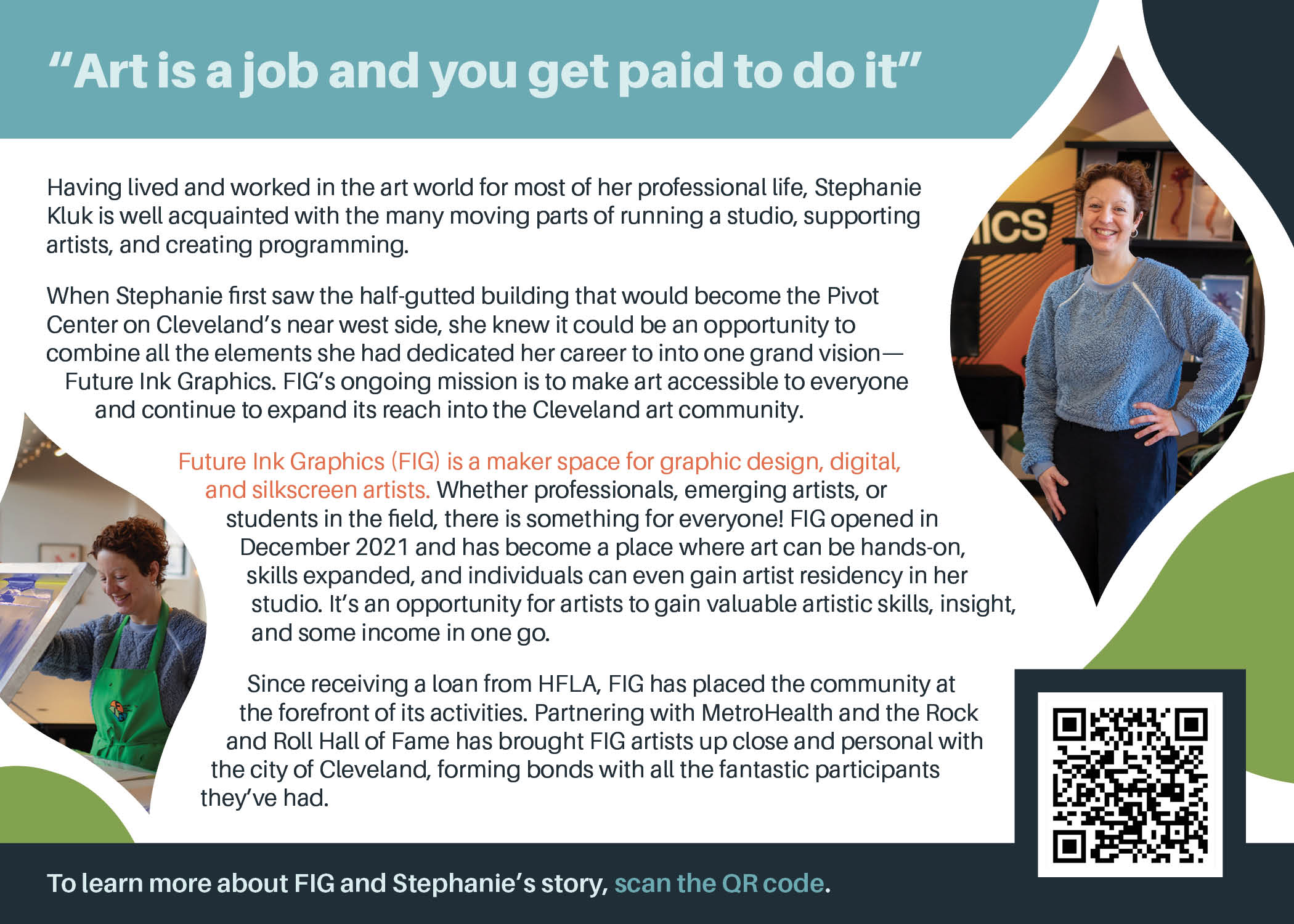

Art has always been deeply entrenched in Stephanie Kluk’s life. Whether creating programming for Chicago artists, supporting students in the Cleveland Metropolitan School District in art education, or cultivating an art co-op, Stephanie has always found herself in creative places.

So when she saw the raw space that eventually became the Pivot Center, she knew this was where life was leading her next.

Using her previous experience and the close relationships she had cultivated over the years, FIG (Future Ink Graphics) was born. JumpStart, a Cleveland-based nonprofit that helps entrepreneurs turn their dreams into reality, referred her to HFLA, and she was able to start her women-owned art enterprise.

Stephanie has created a space for underrepresented communities, amplified artists through FIG’s artist residency program, and showcased their work the year after their residency has ended. From February 14th to April 11th, this year’s gallery exhibition, “Women Who Print,” celebrates contemporary female printmakers, with a focus on silkscreen printing.

FIG has three major components: Advocacy, Education, and being a Maker Space. In-house FIG hosts workshops, allowing people to get hands-on with the art around them and create something they can proudly call their own, regardless of skillset. Collaboration with local youth programs connects them with over 600 students a year, making art something tangible rather than a skillset reserved for those who already have talent. FIG also rents its space for others to come in and take advantage of the resources FIG has available with the support of the on-site staff.

Their prime location in the Pivot Center has also majorly helped the organization and its artists. Being one of the only privately owned small businesses makes it a bit of an oddball, but that doesn’t stop all the Pivot Center residents from solidifying their community and commissioning FIG for their digital arts and screenprinting services. Artists in FIG’s community gallery also benefit from the exposure that the Pivot Center brings; their proximity to the Cleveland Museum of Art’s Community Art Center usually leads to some spilling over between the two art spaces.

Most of FIG’s work is out in the community, partnering with MetroHealth and the Rock and Roll of Fame to bring art to people, programming attracting about 1000 people yearly. Word of mouth and personal referrals have been incredibly successful in getting the word out about her space, but she hopes to see further investments in small organizations and more Clevelanders patronizing local businesses. Being involved in the community supports the city, business owners, and their teams and builds lasting relationships.

The Future of Consumer Financial Protections--A Call to Action

To say that the changes being made at The Consumer Financial Protection Bureau are alarming and bad for everyday consumers is an understatement. The CFPB was created in the wake of the 2008 stock market crash and subsequent recession. During this economic downturn, one in four Americans lost at least 75% of their wealth.

For example, the CFPB sued three of the nation’s largest banks over their mishandling of the payment service Zelle, asserting that these banks were failing to protect consumers from fraud amounting to hundreds of millions of dollars. As of this writing, nearly all cases the CFPB has brought to the courts to protect consumers have been discontinued or paused. This is an app that is used everyday, by everyday consumers and the CFPB is making sure it is safe.

How we got here

Its mission is clear: “to protect consumers from unfair, deceptive, or abusive practices in the financial services industry.” It is a watchdog agency that provides a single point of accountability for enforcing consumer financial laws and protecting consumers in the marketplace.

This work includes:

- Rooting out unfair, deceptive, or abusive acts or practices by writing rules, supervising companies, and enforcing the law

- Enforcing laws that outlaw discrimination in consumer finance

- Taking consumer complaints

- Enhancing financial education

- Researching the consumer experience of using financial products

- Monitoring financial markets for new risks to consumers

They act as a law enforcement arm against corporations, along with monitoring markets and providing resources for people to educate themselves. They have received 6.8 million complaints from consumers; within that number, over 4.6 million are regarding credit reporting, over 83,000 regarding medical debt collection, and over 96,000 regarding student loans. Holding the financial marketplace accountable ensures that everyone’s livelihoods are protected.

Where we are now

Since taking office, the CFPB has been a target for President Trump and the work of the Department of Government Efficiency. Acting CFPB director Russell Vought, who ordered a stop to all work for 2000 employees, has been clear in his desire and directive to dismantle the agency. While there have been critics of the agency since its inception, it can be argued that the work of the CFPB has changed the consumer financial marketplace, making it more fair and transparent for everyday consumers. The CFPB led the way in taking action against bank overdraft policies and other unfair fees and punitive terms.

CFPB has been a safeguard for so many individuals. The current administration is leaving the American people vulnerable to the whims of corporations that want to skirt past rules and regulations. Institutions will be able to cut corners, even if that means directly hurting their customers, because no one is watching.

It is not just an attack from the administration. There is currently a GOP-sponsored joint resolution in the House (H.J. 59) and Senate (S.J. 18) which seeks to remove all caps on overdraft fees, allowing banks to charge whatever they like.

If you agree that it is important to block the return of predatory bank fees and that removing the financial watchdog that protects Americans from unfair financial practices, call your representatives and let them know. If you are in Ohio, here are the numbers to call:

Senator Bernie Moreno: 202-224-2315

Senator John Husted: 202-224-3353

Representative Shontel Brown (Northeast Ohio): 202-225-7032

Here is a sample script:

“Hi, my name is [NAME] and I am a constituent from Cleveland.

I’m calling to demand [Senator/Representative ______] oppose [(H.J. 59) or (S.J. 18), depending on who you are calling], which would overturn the CFPB rule limiting overdraft fees to five dollars. This rule has the potential to save consumers five billion dollars annually and protects consumers from unreasonable and unpredictable banking fees.

Thank you for your time and consideration.”

If leaving a voicemail: Please leave your full street address to ensure your call is tallied.

(Script provided by the 5 Calls app)

To Loan or Not to Loan?...The Future of HFLA Auto Loans

Photo by Tim Mossholder on Unsplash

To Loan or Not to Loan?...Auto Loans

What does car ownership look like in 2025? We are not floating around in flying cars like we were promised. In fact, buying and owning a car feels more challenging and complex than ever. Between skyrocketing (pun intended) costs and the interest rate rollercoaster, many people do not know where to begin. In 2022, HFLA launched an auto loan to help simplify the process and make owning a car more accessible. After two years of this loan product, we found more questions than answers. Can we keep up with demand? Do these loans align with our lending principles? Can we manage the mechanics of these complicated loans?

Bloomberg reports that car repossessions increased to 23% in 2024, up 14% from the 2019 pre-pandemic levels. Why is this happening? During the pandemic, lenders were more lenient with payment schedules, giving people some flexibility during those unprecedented times. Times have become… precedented again. Inflation has shifted, and monthly car payments have gone to near-record highs. “The average interest rate for a new car is currently 7.3%, and for a used car, it’s 11.5%, according to Edmunds data. That means, on average, monthly bills are now $739 for a new car and $549 for a used car.” In June 2024, over 5% of auto borrowers were at least 2 months late.

Generally speaking, everything is getting more expensive. The cost of living has increased across the board. The Bureau of Labor Statistics reports that the Consumer Price Index has risen 2.7% for the past 12 months (ending in November 2024), with food, shelter, and energy indexes all rising. With personal budgets becoming tight and wages stagnant, there is increased distress on the consumer. People have to choose between rent, food, and utilities. As expenses become overwhelmingly inflated, auto payments become deprioritized, which used to be the priority due to fear of repossession.

Where does HFLA fit in all of this?

In January 2022, HFLA began offering auto loans intended to support the purchase of automobiles. Our auto loans went up to $15,000–larger than all of our other personal loans and had a monthly payment of no more than $250.

Auto loans have allowed people to purchase a car. But is this just pushing off the inevitable? Cars are expensive investments, and most people’s livelihoods revolve around having one. Cars have become a modern essential, whether people travel to and from work, run crucial errands, make appointments, or work with their car (Ubering or Dooordashing).

But have people become burdened by the same thing meant to assist them? This question led us to pause our auto purchase loans in the Fall of 2024.

One of our borrowers, Pat Nolan, is a perfect case study to follow our position on auto loans.

Nolan learned about HFLA after the Western Reserve Land Conservancy bought his home in the Euclid Beach Mobile Home Community. This decision “felt like a rug had been pulled out from under us,” Nolan explained, recounting the community banding together to ensure that their neighbors were treated fairly and given just compensation. Some people, like Nolan, had been in this neighborhood for over 10 years and were not expecting this sudden lifestyle shift. HFLA partnered with the Western Reserve Land Conservancy, making loans to those who needed a little extra to smoothly transition to a new location.

Having to move put distance between him and his mother, who still lived in the area. Our auto loans seemed like a perfect solution.

“Cars are great when they work, and they're a pain when they don’t,” Nolan states. Anyone who has owned a car knows that sentiment well. Nolan purchased a used car and, within a few months, the transmission blew out. Nolan returned to us to increase his loan and beagle to afford the necessary parts. Because he had not borrowed the maximum amount available, we increased his loan, and he received a 3-year unlimited-mile warranty on his transmission.

But cases of unexpected car troubles happened incredibly often to our other borrowers.

When it comes to owning a vehicle, there are many moving parts: insurance, car payments, parking fees – without even factoring in unexpected (but inevitable) expenses, like flat tires, busted transmissions, and general damages that occur when simply operating a vehicle.

While people are paying off their car loans, a lot can happen during that period. The average auto loan term is 68 months, and plenty of incidents can happen during that time. This is what makes offering auto loans so tricky. We pride ourselves on helping people get on the path to financial stability. However, many of our borrowers could not get their footing, even with their loans.

In the situation where someone can no longer pay their auto loan, where does that put us? We are not in the business of repossession; it goes against the very core of our mission. We look to help our community members, not become a threatening presence that can take someone’s livelihood away. Our loans are intended to stabilize individuals and families and help them through treacherous financial times. These loans were increasingly putting people in precarious financial positions.

We continue offering interest-free auto repair loans and refinancing loans up to $10,000. We value our role as a vital community resource. Although our auto purchase loans didn't go as expected, we're looking ahead and exploring new opportunities to better serve Northeast Ohio.

Unbanked and Underserved: The Importance of a Bank Account

Nationally, more people than ever are opening bank accounts. Opening and maintaining a bank account can be one of the most effective ways to achieve your financial goals, including increasing your credit score, buying a house, or just finding financial security. In 2023, the US’s unbanked rate dropped to 4.2%-- the lowest level since 2009. Northeast Ohio, however, is seeing a different trend. The unbanked rate in NEO increased from 2.0% in 2021 to 5.4% in 2023–an increase of over 3%!

There are a variety of reasons why people avoid mainstream financial institutions:

- Lack of trust: Many groups have been victims of racist and exclusionary practices by the mainstream financial industry that have systematically left them out of the system.

- Minimum Deposit: Until recently, most banks required a minimum amount to even open an account and maintain the account, making them inaccessible for many people with inconsistent income.

- Fees: With inconsistent income, many people face high overdraft and/or administrative fees, making traditional banking too costly.

Groups that are typically left out of traditional banking tend to be “lower-income, less-educated, Black, Hispanic, disabled, and single-parent households.” Households of color are five times more likely to be un- or under-banked compared to white households.

Those unable or unwilling to participate in the mainstream financial industry have few other options. For most, the only option is to rely on predatory services that require high fees and implement exorbitant interest rates, forcing people to pay up to 5% of their income to access their own money. This could add up to over $40,000 over one’s lifetime. These predatory lenders send people into a cycle of debt that becomes untenable and leads people further into financial instability. Even those who may have a bank account can be considered “underbanked” when they still rely on nonbank financial services, such as check cashing services or pawn shops, and therefore are still vulnerable to exploitative practices.

This is not inevitable. Bank accounts provide many opportunities in the modern economy, like establishing and building credit, avoiding fees to access their money, and growing wealth.

The Consumer Financial Protection Bureau under the Biden Administration has recently ruled to crack down on bank overdraft fees, offering banks the option to either have a flat $5 fee, cap the fee to cover costs and losses, or “charge any fee but disclose the terms of the overdraft loan they extend to customers the same way they would for those of any other loan.” This new rule can save consumers $5 billion, or roughly $225 per household. Many banks have stepped up to the challenge of making mainstream banking more accessible. Working with the Bank On National Advisory Board and Coalitions across the country, like the ones in Cleveland and Summit County, banks have lowered the barriers to banking. This includes limiting fees, removing minimum balance requirements, and working with community partners to connect people to accounts.

HFLA of Northeast Ohio can provide a third option.

HFLA has offered 0% interest loans for 120 years. Rather than continuing to spiral into a perpetual cycle of uncertainty, our loans give people the chance to stabilize their financial situation and start on the path of rebuilding. Our applicants are individuals who often get turned away from traditional banks. They are seeking help to address a need like a required home repair, medical bills, or to get out from predatory loans. We ensure that our loans are accessible, affordable, fast, and fair. Our loans are not “easier” to qualify for, but we work to remove barriers to help people get much needed capital. People are so much more than a 3-digit credit score. We try to understand the whole picture and prioritize repayment history and budgeting plans when considering their application.

There are still some barriers. All of our loans require a cosigner or guarantor. As a nonprofit, we rely on our loans being paid back to continue our work. Co-signers and guarantors provide a level of security to ensure that the loan is paid back in full.

Our staff will work with an individual through the complete repayment of the loan. Successful repayment is just as important to us as their loan payments go back into our revolving loan fund to help fund someone else’s loan, continuing the cycle. Our hope is that you come to HFLA for your first loan and through our support (and credit reporting) you will be able to access the mainstream financial system for your second loan.

With unbanked rates increasing in the Northeast Ohio area, support is needed now more than ever. Since 1904 HFLA has created financial opportunities for its community. If you want to support HFLA’s mission, you can donate here to assist with operational costs to keep our organization going. If you know someone who might benefit from an HFLA loan, please visit us at interestfree.org or contact us at team@interestfree.org.

To learn more about this topic, take a look at the Federal Reserve Bank of Cleveland’s FedTalk: “A Continued Discussion on Financial and Payments Inclusion”.

Broadway and Credit Checks?

Credit scores and credit checks hold many back when it comes to fulfilling their “sueñitas” (dreams).

While I was watching In the Heights, the newest Broadway Musical turned movie from Lin-Manuel Miranda, there was one scene in particular that stopped me in my tracks. It wasn’t one of the beautifully choreographed dance scenes, which were also heart stopping. It was a scene that gets to the heart of what HFLA of Northeast Ohio does–help people with bad or no credit. Here is a brief synopsis: SPOILER ALERT!

Vanessa is a young Latina woman living in Washington Heights, in New York City. She works at a salon, but dreams of moving downtown and becoming a fashion designer. She sees this move as a way of elevating herself and moving up from her neighborhood which she thinks is holding her back.

When submitting her rental application, she is rejected due to a poor credit check and is told that she would need to apply with a co-signer.

Realtor: Ah, Ms. Morales.

Vanessa: Yes.

Realtor: I’m sorry honey, I meant to call you.

Vanessa: Oh, I’ve got bank checks. First month, last month, and security, good as cash.

Realtor: It’s just without a solid credit check, there’s not much I can do. Maybe your parents could co-sign, assuming they can prove income 4 times the rent? You know what, get it to me by 5, I’ll see what I can do.

Despite the fact that Vanessa can prove that she can afford and reliably pay for this apartment, the credit check automatically excludes her from being able to lease the apartment independently. Vanessa does not have any family to ask that could act as a co-signer, and is either too embarrassed to ask someone else or doesn’t think anyone in her community would even be able to co-sign for her.

Seeing this scene unfold is so crucial; it authentically illustrates a real issue that many people face.

As an HFLA staff member, I was shocked to see this plot point in a popular movie, let alone a groundbreaking Broadway musical. We live in a world that does not like to talk about money in a real sense. The narratives we typically see in movies and TV emphasize the character’s poverty and “struggle” more than the systemic barriers that keep them in this cycle and prevent financial growth.

The Difference HFLA Makes

While we do not rent apartments, HFLA of Northeast Ohio has been providing 0% interest loans since 1904. We have never considered a 3-digit credit score as an indicator of an individual’s ability to successfully repay a loan. Instead, we look deeper into the applicant’s repayment history, and more importantly, their current ability to repay a loan based on their income and expenses. We understand the difficulties surrounding building credit. For example, paying rent, utilities and cell phone bills on time does not add to your credit score, but evictions or being sent to collections for not paying bills does. More importantly, we understand the difficulties life can throw at a person, how events and unexpected circumstances can derail one’s dreams and have significant financial consequences.

Though HFLA does not rely on a credit score to determine loan eligibility, we do require that all loan applicants sign with a co-signer or guarantor. HFLA is a non-profit organization that charges 0% interest, we count on the loans we disburse being paid back so that these funds can be recycled and disbursed as new loans to others. For HFLA, co-signers provide security for our funds and lending model. However, we do see first hand how this is a barrier for many, even though we have the same standards for co-signers as we do for borrowers–the credit score alone is not a determining factor.

Co-signers do not have to be family. They can be trusted friends or even community leaders. Co-signers are people who step up, and believe in the dreams of their community. HFLA wants to take a moment to praise and acknowledge all of the co-signers who have stepped up and believed in our loan recipients. All of these individuals did so much more than provide security for HFLA, they played an important role in helping build someone’s personal credit and ability to grow wealth.

HFLA understands that it can be a risk to co-sign for someone, but this risk can uplift, support, and grow one’s community, helping our neighbors achieve their sueñitas.

As the plot of In the Heights unfolds (and I will try to not give too much away) Vanessa’s friend finds her rejected rental application. He takes it to Vanessa’s boss to ask her to co-sign, which she does. This allows Vanessa to live her sueñita, and get her dream apartment downtown.

Our Advice: Know What is in Your Credit Report!

Check out these tips from HFLA Program Director, Brady Gasser.

Find more tips at Nerd Wallet.

1. Know what is in your report and how it affects you.

- Reports are available for free on a weekly basis until April 2022.

- Evictions are particularly detrimental for renters.

2. Know immediate actions that you can take.

- Pay down revolving accounts if possible (i.e. credit cards).

- Pay off derogatory accounts if possible (i.e. collections, charge-offs).

- Check for accuracy and report disputes when appropriate.

3. Know what habits you need to instill over the long-term.

- Make on time payments.

- Keep overall credit utilization low.

- Be careful about taking on debt and look for alternatives.